Seagate 2014 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2014 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TableofContents

SEAGATETECHNOLOGYPLC

NOTESTOCONSOLIDATEDFINANCIALSTATEMENTS—(Continued)

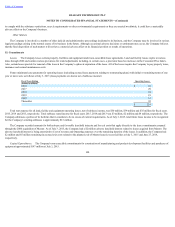

granted.AsofJuly3,2015,therewereapproximately40.0millionordinarysharesavailableforissuanceundertheEIP.

SeagateTechnologyplcStockPurchasePlan(the"ESPP").Thereare50.0millionordinarysharesauthorizedtobeissuedundertheESPP.Innoeventshall

thetotalnumberofsharesissuedundertheESPPexceed75.0millionordinaryshares.TheESPPconsistsofasix-monthofferingperiodwithamaximumissuance

of1.5millionordinarysharesperofferingperiod.TheESPPpermitseligibleemployeestopurchaseordinarysharesthroughpayrolldeductionsgenerallyat85%of

thefairmarketvalueoftheordinaryshares.AsofJuly3,2015therewereapproximately8.9millionordinarysharesavailableforissuanceundertheESPP.

LyveMindsInc.2012EquityIncentivePlan(the"LyveMindsPlan").OnOctober19,2012,LyveMindsInc.,amajority-ownedsubsidiaryoftheCompany,

adoptedtheLyveMindsInc.2012EquityIncentivePlan(the"LyveMindsPlan").Amaximumof31.9millionsharesofLyveMinds'commonstockareissuable

undertheLyveMindsPlantoemployees,directors,andconsultantsofLyveMinds.OptionsgrantedtoLyveMindsemployeesgenerallyvestasfollows:25%ofthe

optionsonthefirstanniversaryofthevestingcommencementdateandtheremaining75%proportionatelyeachmonthoverthenext36months.Optionsexpireten

yearsfromthedateofgrant.LyveMinds,Inc.adoptedtheAmendedandRestated2012EquityIncentivePlanonMarch26,2014inconnectionwithLyveMinds'

reincorporationasaDelawarecorporation.ThecompensationexpenseassociatedwithoptionsgrantedtodateundertheLyveMindsPlanwasnotmaterialforfiscal

years2015,2014,and2013,respectively.

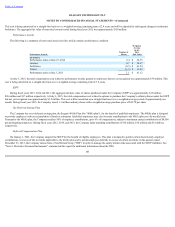

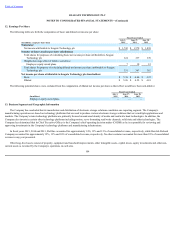

EquityAwards

Full-ValueShareAwards(e.g.restrictedshareunits)generallyvestoveraperiodofthreetofouryears,withcliffvestingofaportionofeachawardoccurring

annually.Optionsgenerallyvestasfollows:25%oftheoptionswillvestonthefirstanniversaryofthevestingcommencementdateandtheremaining75%will

vestratablyeachmonththereafteroverthenext36months.OptionsgrantedundertheEIPandSCPhaveanexercisepriceequaltotheclosingpriceofthe

Company'sordinarysharesondateofgrant.

TheCompanygrantedperformanceawardstoitsseniorexecutiveofficersundertheSCPandtheEIPwherevestingissubjecttoboththecontinued

employmentoftheparticipantbytheCompanyandtheachievementofcertainperformancegoalsestablishedbytheCompensationCommitteeoftheCompany's

BoardofDirectors,includingmarketbasedperformancegoals.AsingleawardrepresentstherighttoreceiveasingleordinaryshareoftheCompany.Duringfiscal

years2015,2014and2013,theCompanygranted0.3million,0.4millionand0.7millionperformanceawards,respectively,whereperformanceismeasuredbased

onathree-yearaveragereturnoninvestedcapital(ROIC)goalandarelativetotalshareholderreturn(TSR)goal,whichisbasedontheCompany'sordinaryshares

measuredagainstabenchmarkTSRofapeergroupoverthesamethree-yearperiod(the"TSR/ROIC"awards).Theseawardsvestaftertheendoftheperformance

periodofthreeyearsfromthegrantdate.ApercentageoftheseunitsmayvestonlyifatleasttheminimumROICgoalismetregardlessofwhethertheTSRgoalis

met.Thenumberofstockunitstovestwillrangefrom0%to200%ofthetargetedunits.Inevaluatingthefairvalueoftheseunits,theCompanyusedaMonte

Carlosimulationonthegrantdate,takingthemarket-basedTSRgoalintoconsideration.Compensationexpenserelatedtotheseunitsisonlyrecordedinaperiodif

itisprobablethattheROICgoalwillbemet,anditistoberecordedattheexpectedlevelofachievement.

TheCompanyalsogranted0.4million,0.3millionand0.3millionperformanceawardsduringfiscalyears2015,2014and2013respectively,toitssenior

executiveofficerswhicharesubjecttoaperformancegoalrelatedtotheCompany'sadjustedearningspershare(the"AEPS"awards).Theseawardshavea

99