Seagate 2014 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2014 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TableofContents

SEAGATETECHNOLOGYPLC

NOTESTOCONSOLIDATEDFINANCIALSTATEMENTS—(Continued)

assetsandliabilitiesathistoricalrates.GainsandlossesfromtheseremeasurementswerenotsignificantandhavebeenincludedintheCompany'sresultsof

operations.

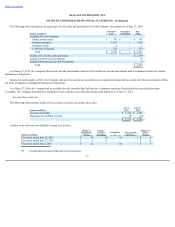

Concentrations

ConcentrationofCreditRisk.TheCompany'scustomerbasefordiskdriveproductsisconcentratedwithasmallnumberofOEMsanddistributors.The

Companydoesnotgenerallyrequirecollateralorothersecuritytosupportaccountsreceivable.Toreducecreditrisk,theCompanyperformsongoingcredit

evaluationsonitscustomers'financialcondition.TheCompanyestablishesanallowancefordoubtfulaccountsbaseduponfactorssurroundingthecreditriskof

customers,historicaltrendsandotherinformation.Hewlett-PackardCompanyandDellInc.eachaccountedformorethan10%oftheCompany'saccounts

receivableasofJuly3,2015.

FinancialinstrumentsthatpotentiallysubjecttheCompanytoconcentrationsofcreditriskconsistprimarilyofcashequivalents,short-terminvestmentsand

foreigncurrencyforwardexchangecontracts.TheCompanyfurthermitigatesconcentrationsofcreditriskinitsinvestmentsthroughdiversification,bylimitingits

investmentsinthedebtsecuritiesofasingleissuer,andinvestinginhighlyratedsecurities.

Inenteringintoforeigncurrencyforwardexchangecontracts,theCompanyassumestheriskthatmightarisefromthepossibleinabilityofcounterpartiesto

meetthetermsoftheircontracts.Thecounterpartiestothesecontractsaremajormultinationalcommercialbanks,andtheCompanyhasnotincurredanddoesnot

expectanylossesasaresultofcounterpartydefaults.

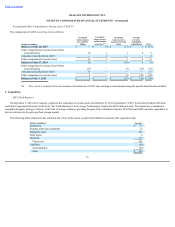

SupplierConcentration.Certainoftherawmaterials,componentsandequipmentusedbytheCompanyinthemanufactureofitsproductsareavailable

fromasolesupplieroralimitednumberofsuppliers.Shortagescouldoccurintheseessentialmaterialsandcomponentsduetoaninterruptionofsupplyor

increaseddemandintheindustry.IftheCompanywereunabletoprocurecertainmaterials,componentsorequipmentatacceptableprices,itwouldberequiredto

reduceitsmanufacturingoperations,whichcouldhaveamaterialadverseeffectonitsresultsofoperations.Inaddition,theCompanyhasmadeprepaymentsto

certainsuppliers.Shouldthesesuppliersbeunabletodeliverontheirobligationsorexperiencefinancialdifficulty,theCompanymaynotbeabletorecoverthese

prepayments.

RecentAccountingPronouncements

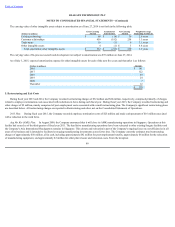

InMay2014,theFASBissuedASU2014-09(ASCTopic606),RevenuefromContractswithCustomers.TheASUoutlinesasinglecomprehensivemodelfor

entitiestouseinaccountingforrevenuearisingfromcontractswithcustomersandsupersedesmostcurrentrevenuerecognitionguidance,includingindustry-

specificguidance.Italsorequiresentitiestodisclosebothquantitativeandqualitativeinformationthatenablefinancialstatementsuserstounderstandthenature,

amount,timing,anduncertaintyofrevenueandcashflowsarisingfromcontractswithcustomers.TheamendmentsinthisASUareeffectiveforfiscalyears,and

interimperiodswithinthoseyears,beginningafterDecember15,2017.EarlyadoptionispermittedforannualperiodsbeginningafterDecember15,2016.The

Companyisintheprocessofassessingtheimpact,ifany,onitsconsolidatedfinancialstatements.

InApril2015,theFASBissuedASU2015-03(ASCSubtopic835-30),Interest-ImputationofInterest:SimplifyingthePresentationofDebtIssuanceCosts.

TheamendmentsinthisASUrequirethatdebtissuancecostsrelatedtoarecognizeddebtliabilitybepresentedinthebalancesheetasadirectdeductionfromthe

carryingamountofthatdebtliability.TheamendmentsinthisASUareeffectiveforfiscalyears,andinterimperiodswithinthoseyears,beginningafter

December15,2015.Earlyadoptionispermittedforfinancialstatementsthathavenotbeenpreviouslyissued.Theadoptionofthisnewguidancewillnothavea

materialimpactontheCompany'sconsolidatedfinancialstatementsanddisclosures.

71