Seagate 2003 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2003 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

24,000,000 newly issued common shares of approximately $270 million after deducting underwriting fees, discounts and commissions.

Immediately prior to the closing of the Company’s initial public offering, it paid a return of capital distribution of approximately $262 million,

or $0.65 per share, to the holders of its then-outstanding shares, including New SAC, which received $259 million. The Company also paid a

lump sum of approximately $12 million to members of its sponsor group in exchange for the discontinuation of an annual monitoring fee of $2

million. This payment was charged to marketing and administrative expense during the quarter ended December 27, 2002. New SAC received

proceeds of approximately $557 million from the sale of 48,500,000 common shares in the Company’s initial public offering, after deducting

underwriting discounts and commissions. New SAC distributed the $557 million net proceeds from the offering and the $259 million return of

capital distribution from the Company to its preferred and ordinary shareholders, including a total payment of approximately $38 million to

officers and employees of the Company who held preferred and ordinary shares of New SAC. The distribution by New SAC to its preferred

stock holders triggered the requirement by the Company to pay its remaining deferred compensation plan obligation to its participating officers

and employees totaling $147 million, which was paid in December 2002.

On May 20, 2002, the Company made a distribution to its shareholders, including New SAC, to enable New SAC to make a distribution

to its preferred shareholders. The aggregate amount of the shareholder distribution was approximately $167 million. Of this amount,

approximately $166 million was paid to New SAC. New SAC in turn made a distribution to its preferred shareholders in May 2002 of the

entire $166 million, including the distribution of $5 million to officers and employees of the Company who held preferred shares of New SAC.

The payment of this distribution on preferred shares by New SAC triggered a required payment by the Company under its deferred

compensation plan of $32 million that was paid in May 2002.

On March 19, 2002, the Company paid a distribution of $33 million to its shareholders, including New SAC, to enable New SAC to make

a distribution of approximately $33 million to its shareholders, which allowed members of the Company’s sponsor group to satisfy tax

obligations. Approximately $32 million of this amount was paid to New SAC. New SAC had previously distributed $32 million to its ordinary

shareholders, including the distribution of approximately $7 million paid to officers and employees of the Company that held ordinary shares of

New SAC.

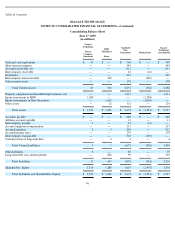

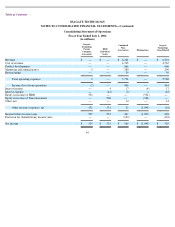

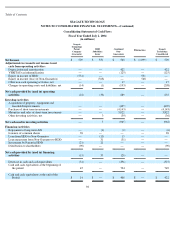

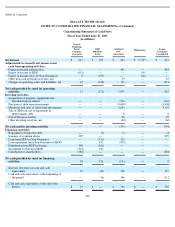

13. Condensed Consolidating Financial Information

On May 13, 2002, Seagate Technology HDD Holdings, or HDD, issued $400 million in aggregate principal amount of 8% senior notes

due 2009. HDD is the Company’s wholly-owned direct subsidiary, and the Company has guaranteed HDD’s obligations under the 8% senior

notes, on a joint and several, full and unconditional basis. The following tables present parent guarantor, subsidiary issuer and combined non-

guarantors condensed consolidating balance sheets of the Company and its subsidiaries at July 2, 2004 and June 27, 2003 and the condensed

consolidating results of operations and cash flows for the fiscal years ended July 2, 2004, June 27, 2003 and June 28, 2002. The information

classifies the Company’s subsidiaries into Seagate Technology-parent company guarantor, HDD-subsidiary issuer, and the combined non-

guarantors based upon the classification of those subsidiaries under the terms of the 8% senior notes. The Company is restricted in its ability to

obtain funds from its subsidiaries by dividend or loan under both the indenture governing the 8% senior notes and the credit agreement

governing the senior secured credit facilities. Under each of these instruments, dividends paid by HDD or its restricted subsidiaries would

constitute restricted payments, and loans between the Company and HDD or its restricted subsidiaries would constitute affiliate transactions.

94