Seagate 2003 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2003 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

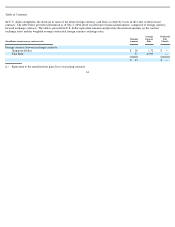

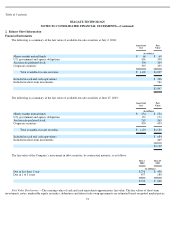

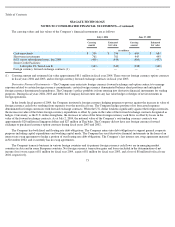

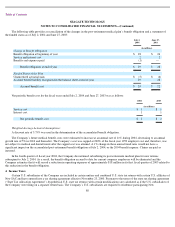

The Company continues to use the intrinsic value method under APB Opinion No. 25, “Accounting for Stock Issued to Employees,” and

related interpretations in accounting for employee stock options because the alternative fair value accounting method provided under SFAS 123

requires the use of option valuation models, such as the Black-Scholes option-pricing model used by the Company, that were not developed for

use in valuing employee stock options. The Black-Scholes option-pricing model was developed for use in estimating the fair value of traded

options that have no vesting restrictions and are fully transferable. In addition, the Black-Scholes model requires the input of highly subjective

assumptions, including the expected stock price volatility. The pro forma information under SFAS123, as amended by SFAS 148, is as follows

(in millions, except per share data):

No tax effects were included in the determination of pro forma net income because the deferred tax asset resulting from stock-based

employee compensation would be offset by an additional valuation allowance for deferred tax assets. The effects on pro forma disclosures of

applying SFAS 123 may not be representative of the effects on pro forma disclosures in future periods because the Company only began

granting options to employees in July 2001. See Note 3, Compensation—Stock-Based Benefit Plans, for a discussion of the Company’s

assumptions used to estimate stock-based compensation expense under SFAS 123.

Consummation of Secondary Public Offering

Fiscal Years Ended

July 2,

2004

June 27,

2003

June 28,

2002

Net income

—

as reported

$

529

$

641

$

153

Add

-

back: Stock

-

based employee compensation expense included in net income

3

2

—

Deduct: Total stock-based employee compensation expense determined under

fair value method

(62

)

(38

)

(16

)

Net income

—

pro forma

$

470

$

605

$

137

Earnings per share:

Basic

—

as reported

$

1.17

$

1.53

$

0.38

Basic

—

pro forma

1.04

1.45

0.34

Diluted

—

as reported

1.06

1.36

0.36

Diluted

—

pro forma

0.95

1.30

0.32

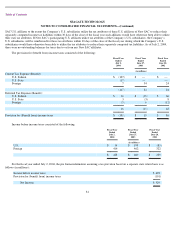

Under the Seagate Technology shareholders agreement among New SAC, the Company’s financial sponsors and the Company, New

SAC has demand registration rights to request from time to time that the Company register to sell shares of its common stock held by New

SAC. New SAC exercised this right and, on July 30, 2003, the Company completed the secondary public offering of 69,000,000 of its common

shares, of which 9,000,000 were sold pursuant to the underwriters’ exercise of their over-

allotment option, all of which were sold by New SAC,

as selling shareholder, at a price of $18.75 per share. New SAC received proceeds of approximately $1.3 billion, after deducting underwriting

discounts and commissions of approximately $39 million. The Company incurred direct expenses aggregating approximately $1 million related

to the offering. New SAC distributed its net proceeds to holders of its ordinary shares including approximately $245 million distributed to the

Company’s officers and employees who hold ordinary shares of New SAC.

71