Seagate 2003 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2003 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

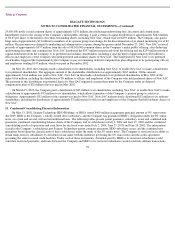

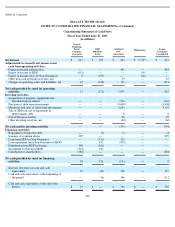

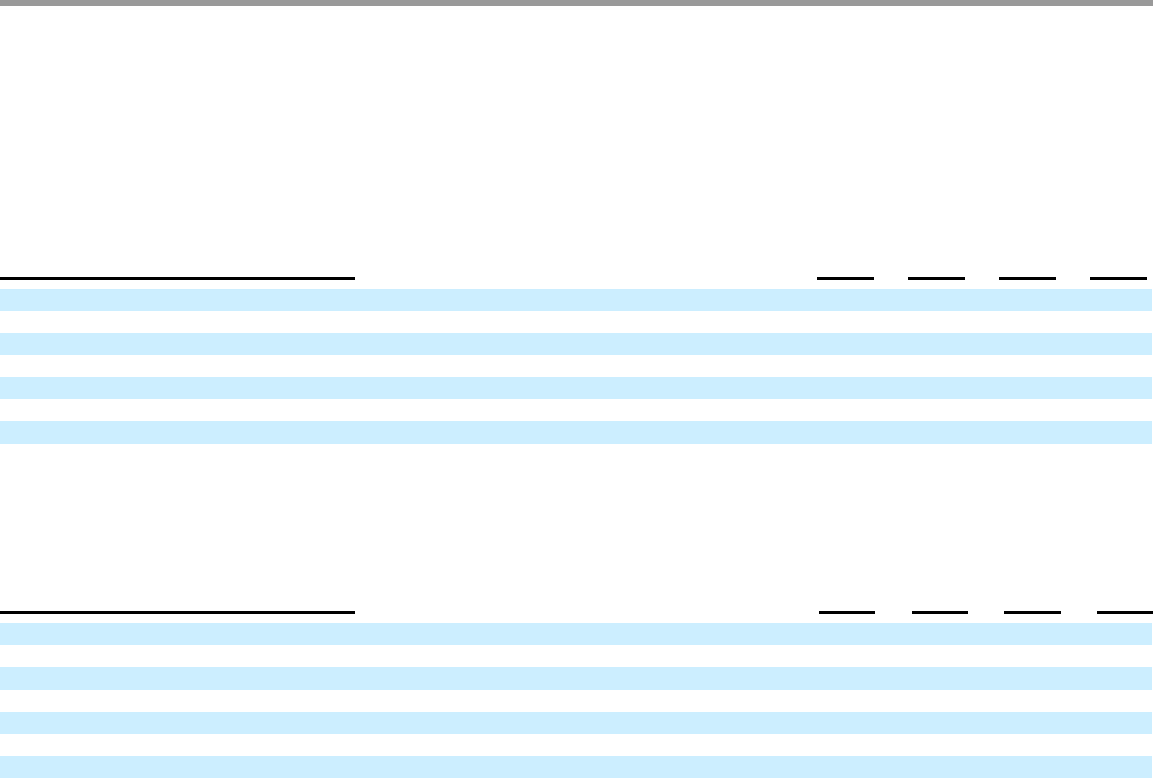

14. Supplementary Financial Data (Unaudited)

Quarterly Data

The results for the first quarter of fiscal year 2004 include an $11 million restructuring charge. The results for the second quarter include

a $4 million restructuring charge. The results for the third quarter include a $125 million income tax benefit and a $6 million restructuring

charge. The results for the fourth quarter include a $39 million restructuring charge and a $2 million write-down of an investment in a private

company.

The results for the first quarter of fiscal year 2003 include a $7 million net restructuring charge. The results for the second quarter include

an $8 million write-

down of an investment in a private company. The results for the fourth quarter include a $2 million restructuring charge and

a $2 million write-down of an investment in a private company.

15. Subsequent Events

Fiscal Year 2004

Unaudited, in millions except per share data

1st

2nd

3rd

4th

Revenue

$

1,740

$

1,760

$

1,388

$

1,336

Gross margin

468

461

301

229

Income (loss) from operations

210

218

53

(37

)

Net income (loss)

198

205

159

(33

)

Net income (loss) per share:

Basic

$

0.44

$

0.46

$

0.35

$

(0.07

)

Diluted

0.40

0.41

0.32

(0.07

)

Fiscal Year 2003

Unaudited, in millions except per share data

1st

2nd

3rd

4th

Revenue

$

1,579

$

1,734

$

1,620

$

1,553

Gross margin

372

493

434

428

Income from operations

119

219

182

171

Net income

110

198

174

160

Net income per share:

Basic

$

0.27

$

0.49

$

0.41

$

0.37

Diluted

0.24

0.43

0.37

0.33

Registration of Common Shares

On July 20, 2004, the Company filed a registration statement on Form S-3 with respect to 60,000,000 common shares of the Company

owned by New SAC. After this registration statement is declared effective by the SEC, New SAC may sell all 60,000,000 of these shares to the

public. The Company will not receive any of the proceeds from the potential sale of these shares. After such sale or sales of these common

shares is completed, New SAC will own 222,500,000 shares, or approximately 48.4% of the Company’s outstanding common stock (based

upon the Company’s outstanding common shares as of July 2, 2004).

103