Seagate 2003 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2003 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Stock Purchase Plan —The Company established an Employee Stock Purchase Plan (“ESPP plan”) in December 2002. A total of

20,000,000 shares of common stock have been authorized for issuance under the ESPP plan, plus an automatic annual increase on the first day

of the Company’s fiscal year beginning in 2003 equal to the lesser of 2,500,000 shares or 0.5% of the outstanding shares on the last day of the

immediately preceding fiscal year, or such lesser number of shares as is determined by the Company’s board of directors. In no event shall the

total number of shares issued under the ESPP plan exceed 75,000,000 shares. The ESPP plan permits eligible employees who have completed

thirty days of employment prior to the commencement of any offering period to purchase common stock through payroll deductions generally

at 85% of the fair market value of the common stock. The ESPP plan has two six-month purchase periods and contains a “rollover” feature if

the market price of the stock at the end of any six-

month purchase period is lower than the stock price at the beginning of the offering period. In

that case, the plan is immediately canceled after that purchase date, and a new one-year plan is established using the then-current stock price as

the base purchase price.

On July 31, 2003, the purchase date for the ESPP’s first purchase period, a total of 2,496,495 shares of the Company’s common stock

were issued. The weighted average exercise price for these shares issued upon the exercise of outstanding rights pursuant to the ESPP was

$10.20 per share. On January 30, 2004, the purchase date for the ESPP’s second purchase period, a total of 2,483,371 shares of the Company’s

common stock were issued. The weighted average exercise price for these shares issued upon the exercise of outstanding rights pursuant to the

ESPP was $10.37 per share.

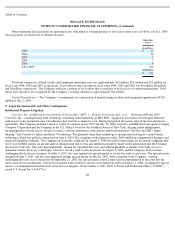

Assumptions Used in Determining Pro Forma Information —See Note 1, Summary of Significant Accounting Policies, for pro forma

information on net income and earnings per share required under SFAS 123, as amended by SFAS 148.

Up until the Company’s initial public offering of its common stock in December 2002, the fair value of the Company’s stock options was

estimated using the Black-Scholes valuation method with minimum volatility. For all employee stock options issued subsequent to December

11, 2002, the Company estimated the fair value of stock options issued to employees using the Black-Scholes valuation method with a

volatility factor based on the stock volatilities of its largest publicly traded competitors.

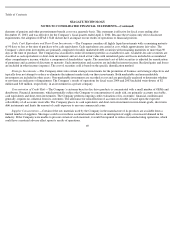

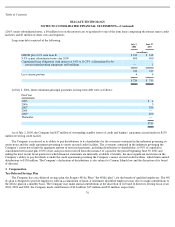

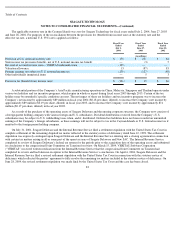

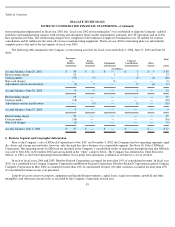

The following table summarizes information about options outstanding at July 2, 2004 (shares in millions).

78

Outstanding Options

Exercisable Options

Range of

Exercise Prices

Number of

Shares

Weighted Average

Contractual Life

(in years)

Weighted Average

Exercise Price

Number of

Shares

Weighted Average

Exercise Price

$ 2.30

–

3.00

30.2

7.0

$

2.30

24.3

$

2.30

3.00

–

6.00

8.8

7.6

5.00

.4

5.00

6.00

–

9.00

1.6

8.6

8.22

—

8.22

9.00

–

12.00

14.8

8.5

10.14

4.1

10.13

12.00

–

15.00

.7

9.2

13.13

.1

13.55

15.00

–

18.00

.5

9.4

16.49

.1

16.44

18.00

–

21.00

.7

9.3

19.80

.1

19.65

21.00

–

24.00

1.4

9.1

21.46

—

21.20

24.00

–

27.00

1.6

9.2

26.41

—

—

27.00

–

29.85

.1

9.3

28.95

—

—

$ 2.30

–

$

29.85

60.4

7.7

$

6.33

29.1

$

3.56