Seagate 2003 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2003 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

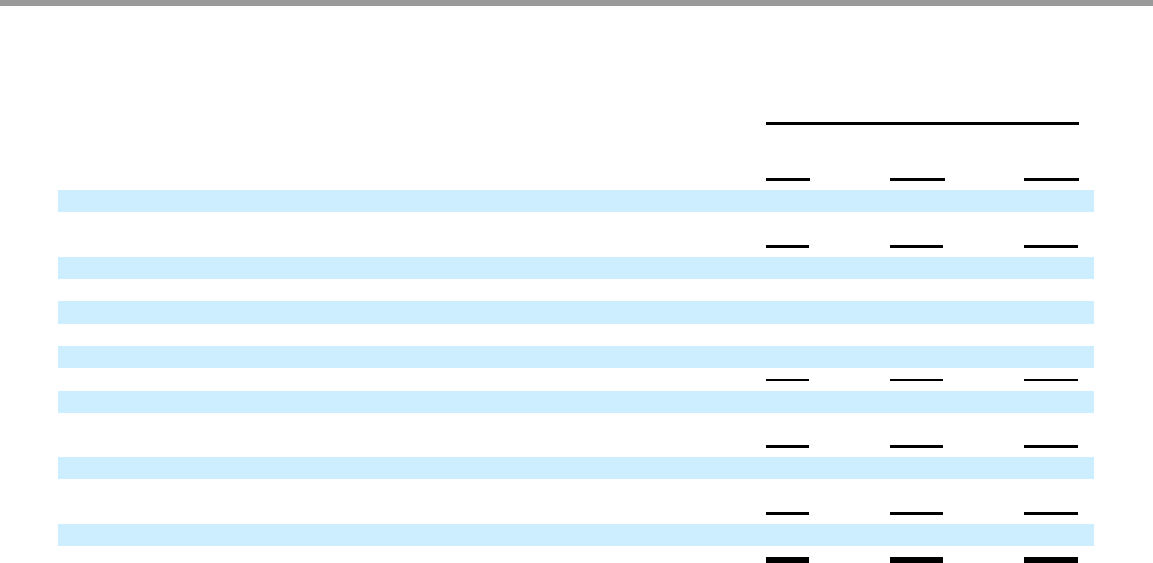

Table of Contents

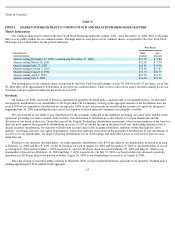

Fiscal Year 2004 Compared to Fiscal Year 2003

Fiscal Year Ended

July 2,

2004

June 27,

2003

June 28,

2002

Revenue

100

%

100

%

100

%

Cost of revenue

77

73

74

Gross margin

23

27

26

Product development

11

10

12

Marketing and administrative

5

6

8

Amortization of intangibles

—

—

—

Restructuring

—

—

—

Income from operations

7

11

6

Other income (expense), net

—

(

1

)

(2

)

Income before income taxes

7

10

4

Provision for (benefit from) income taxes

(2

)

—

1

Net income

9

%

10

%

3

%

Revenue. Revenue for fiscal year 2004 was $6.224 billion, down 4% from $6.486 billion in fiscal year 2003. The decrease in revenue

was primarily due to price erosion, particularly with respect to our enterprise storage products, partially offset by an increase in unit shipments.

Our unit shipments increased from 68 million units in fiscal year 2003 to 79 million units in fiscal year 2004. This increase in unit shipments

was primarily in our desktop storage products and was due to an increase in the total available market, as well as our share of the total available

market. Additionally, shipments increased as a result of the introduction of our mobile computing storage product.

Our overall average unit sales price for our rigid disc drive products was $81, $80, $76 and $71 for the first, second, third and fourth

quarters of fiscal year 2004, respectively. Average annual price erosion from fiscal year 2003 to fiscal year 2004 was approximately 18%.

Unit shipments for desktop storage disc drives were 59.0 million for fiscal year 2004, up from 52.3 million in fiscal year 2003. However,

we did experience a slight decline in drive shipments for desktop applications in the fourth fiscal quarter which can be attributed to an

unexpected decline in industry distribution channel sell-through. Despite this decline, we believe that we maintained our market share.

Unit shipments for enterprise storage disc drives were 10.4 million during fiscal year 2004, slightly down from 10.5 million in fiscal year

2003; and, although we continue to experience aggressive pricing, we believe we maintained our market share.

During fiscal year 2004, we shipped 3.6 million mobile computing disc drives. We continue to be impacted by our limited product set for

this market and our concentrated customer base. We also experienced aggressive pricing in the first half of calendar year 2004. As we leverage

this product platform and expand our product offerings later in calendar year 2004, we expect to penetrate more of the mobile computing

market and capture additional customers, revenue, and market share.

Unit shipments for consumer electronics storage disc drives were 6.3 million during fiscal year 2004, which represents a 33% increase in

shipments from fiscal year 2003. This reflects strong growth in shipments to DVR consumer electronics applications. Until now, we have only

participated in the portion of the consumer electronics market where 3.5-inch form factors drives are utilized. Beginning in our first fiscal

quarter of 2005, we will add to our consumer electronics offerings with the previously announced ST1, our new 5 gigabyte,

28