Seagate 2003 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2003 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

approximately one million units lower than the March quarter. To the extent that our distributor customers reduce their purchases of our

products or prices decline significantly in the distribution channel, our results of operations would be adversely affected.

During periods of slowing growth of areal density and longer product cycles we may experience heightened pricing pressures. This

pricing pressure has contributed to a reduction in gross margins. To the extent that these pricing pressures continue, our gross margin may be

negatively affected. Furthermore, the favorable impact of new product introductions on our results of operations may be minimized.

Historically, the introduction of new products generally has had a favorable impact on our results of operations both because the new products

are introduced at higher prices than existing competitive offerings and because advances in areal density technology have enabled lower

manufacturing costs through reduction in components such as read/write heads and rigid discs. However, in contrast to when the rate of growth

in areal density is increasing, a slowing growth rate in areal density can limit the cost benefits of new products because it is technologically

more difficult to reduce the number of read/write heads and rigid discs in a particular drive. In addition, given the environment of intense price

competition, in the absence of significant capacity increases or improvements in reliability, it is difficult to obtain higher prices for new

products.

We believe that we and the hard drive industry are in a unique and challenging period of time with longer product cycles, continued

aggressive pricing in the core markets and ongoing changes in how we serve our distribution channel partners. All of these may impact our

near-term profitability. In our fourth fiscal quarter of 2004, we undertook significant restructuring activities to reduce the costs of our

operations in light of our declining revenue, gross margins, and earnings over the past several quarters resulting from recent significant price

erosion and market share variability, particularly with respect to our enterprise disc drive products. We continue to look at opportunities for

further cost reductions which may result in additional restructuring activities and restructuring charges in the future. During this challenging

period, the management team will continue to be intensely focused on maintaining profitability excluding the impact of any restructuring

charges that we may incur.

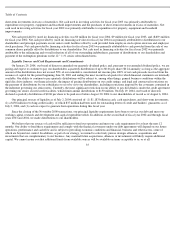

Results of Operations

We list in the tables below the historical consolidated statements of operations in dollars and as a percentage of revenue for the fiscal

years indicated.

27

Fiscal Year Ended

July 2,

2004

June 27,

2003

June 28,

2002

(in millions)

Revenue

$

6,224

$

6,486

$

6,087

Cost of revenue

4,765

4,759

4,494

Gross margin

1,459

1,727

1,593

Product development

666

670

698

Marketing and administrative

290

357

498

Amortization of intangibles

—

—

19

Restructuring

59

9

4

Income from operations

444

691

374

Other income (expense), net

(16

)

(31

)

(135

)

Income before income taxes

428

660

239

Provision for (benefit from) income taxes

(101

)

19

86

Net income

$

529

$

641

$

153