Seagate 2003 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2003 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Estimated reductions to revenue for sales incentive programs, such as price protection, and sales growth bonuses, are recorded when

revenue is recorded. Marketing development programs are either recorded as a reduction to revenue or as an addition to marketing expense

depending on the contractual nature of the program and whether the conditions of EITF 01-09 have been met.

Product Warranty —Enterprise products that are used in large scale servers and data warehousing systems are warranted for three to five

years while personal storage products used in consumer and commercial desktop systems are warranted for one to three years. A provision for

estimated future costs relating to warranty expense is recorded when revenue is recorded and is included in cost of revenue. The Company

offers extended warranties on certain of its products. Deferred revenue in relation to extended warranties has not been material to date.

Shipping and handling costs are also included in cost of revenue.

Inventory —Inventories are valued at the lower of standard cost (which approximates actual cost using the first-in, first-out method) or

market. Market value is based upon an estimated average selling price reduced by estimated cost of completion and disposal.

Property, Equipment, and Leasehold Improvements —Land, equipment, buildings and leasehold improvements are stated at cost.

Equipment and buildings are depreciated using the straight-line method over the estimated useful lives of the assets. Leasehold improvements

are amortized using the straight-line method over the shorter of the estimated life of the asset or the remaining term of the lease.

Advertising Expense —The cost of advertising is expensed as incurred. Advertising costs were approximately $25 million, $28 million

and $29 million in fiscal years 2004, 2003 and 2002, respectively.

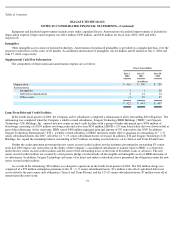

Stock-Based Compensation —The Company accounts for employee stock-based compensation using the intrinsic value method under

Accounting Principles Board Opinion (“APBO”) No. 25, “Accounting for Stock Issued to Employees” (“APBO 25”), and related

interpretations.

Impact of Recently Issued Accounting Standards —In April 2003, the FASB issued SFAS No. 149, “Amendment of Statement 133 on

Derivative Instruments and Hedging Activities,” which amends and clarifies financial accounting and reporting for derivative instruments,

including certain derivative instruments embedded in other contracts and for hedging activities under SFAS No. 133, “Accounting for

Derivative Instruments and Hedging Activities.” SFAS 149 is effective for contracts entered into or modified after June 30, 2003 except for the

provisions that were cleared by the FASB in prior pronouncements. The adoption of SFAS 149 did not have a material impact on the

Company’s results of operations or financial position.

In May 2003, the FASB issued SFAS No. 150, “Accounting for Certain Financial Instruments with Characteristics of both Liabilities and

Equity,” (“SFAS 150”). This statement establishes standards for how an issuer classifies and measures in its statement of financial position

certain financial instruments with characteristics of both liabilities and equity. In accordance with the standard, financial instruments that

embody obligations for the issuer are required to be classified as liabilities. This statement is effective for financial instruments entered into or

modified after May 31, 2003, and was effective in the Company’s fiscal quarter ended October 3, 2003. The adoption of SFAS 150 did not

have a significant impact on the Company’s results of operations or financial position.

In December 2003, the FASB issued a revision to FASB Statement No. 132, “Employers disclosures about Pensions and Other

Postretirement Benefits,” (“SFAS 132-R”).

This statement establishes standards that require companies to provide more details about their plan

assets, benefit obligations, cash flows, benefit costs and other relevant information. In addition to expanded annual disclosures, companies are

required to report the various

68