Seagate 2003 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2003 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

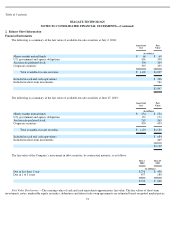

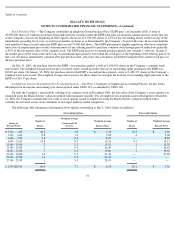

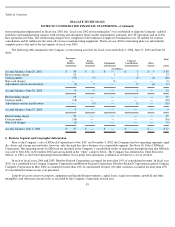

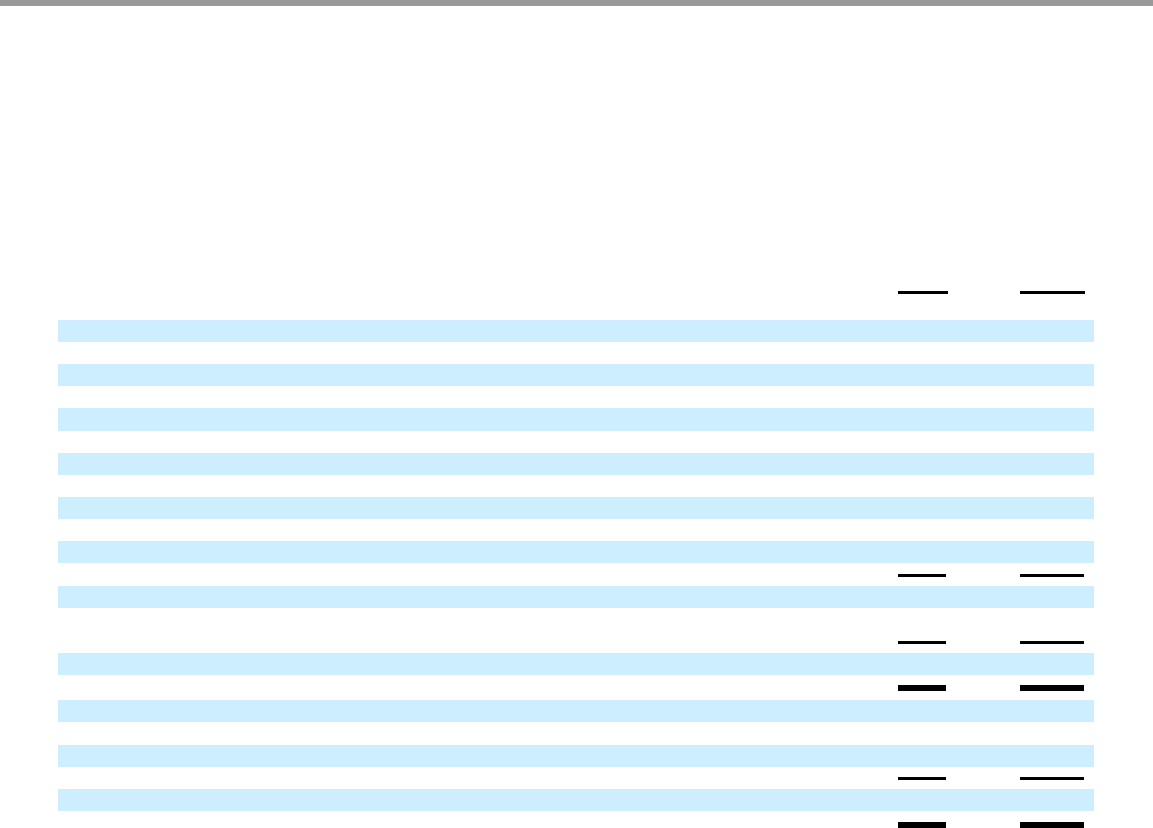

Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of assets and liabilities for

financial reporting purposes and the amounts used for income tax purposes. The significant components of the Company’s deferred tax assets

and liabilities were as follows:

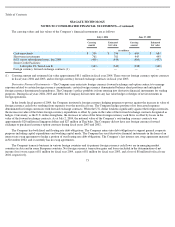

At July 2, 2004, the Company had recorded $58 million of deferred tax assets. The realization of the deferred tax assets is primarily

dependent on the Company generating sufficient U.S. taxable income in fiscal years 2005 and 2006. Although realization is not assured, the

Company’s management believes that it is more likely than not these deferred tax assets will be realized. The amount of deferred tax assets

considered realizable, however, may increase or decrease, when the Company reevaluates the underlying basis for its estimates of future U.S.

and certain foreign taxable income.

In fiscal year 2004, the valuation allowance increased by $125 million. In fiscal years 2003 and 2002, the valuation allowance decreased

by $70 million and $20 million, respectively. Approximately $125 million of the valuation allowance as of July 2, 2004 was attributable to the

U.S. income tax benefits of stock option deductions, the benefit of which will be credited to additional paid-in capital when, and if, realized.

At July 2, 2004, the Company had U.S. and foreign net operating loss carryforwards of approximately $433 million and $124 million,

respectively, which will expire at various dates beginning in 2005, if not utilized. At July 2, 2004, the Company had U.S. tax credit

carryforwards of $74 million, which will expire at various dates beginning in 2006, if not utilized.

Utilization of the U.S. net operating loss and tax credit carryforwards may be subject to a substantial annual limitation due to the

ownership change limitations provided by the Internal Revenue Code of 1986, as amended, and similar state provisions. The annual limitation

may result in the expiration of net operating loss or tax credit carry-forwards before utilization.

82

July 2,

2004

June 27,

2003

(in millions)

Deferred Tax Assets

Accrued warranty

$

51

$

53

Inventory valuation accounts

21

28

Receivable reserves

13

17

Accrued compensation and benefits

53

48

Depreciation

106

103

Restructuring allowance

14

4

Other accruals

37

37

Acquisition related items

2

2

Net operating losses and tax credit carry

-

forwards

288

189

Other assets

14

9

Total Deferred Tax Assets

599

490

Valuation allowance

(541

)

(416

)

Net Deferred Tax Assets

$

58

$

74

As Reported on the Balance Sheet

Other current assets

$

15

$

49

Other assets, net

43

25

Net Deferred Tax Assets

$

58

$

74