Seagate 2003 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2003 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

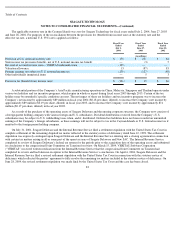

Company’s declaratory judgment action has been stayed. On July 23, 2003, the U.S. Bankruptcy Court approved Western Digital Corporation’

s

bid to acquire the assets of Read-Rite Corporation, including intellectual property that was the subject of Read-Rite’s dispute with the

Company, in a transaction that closed on July 31, 2003. The Company objected to Western Digital’s assumption of the Patent Cross-License

Agreement. On November 14, 2003, the Bankruptcy Trustee made a motion to assume or reject certain Read-

Rite executory contracts, rejecting

the Patent Cross-License Agreement. The Company has given notice of its election to retain the benefits of the Patent Cross-License

Agreement to the extent permitted by Section 365(n) of the U.S. Bankruptcy Code.

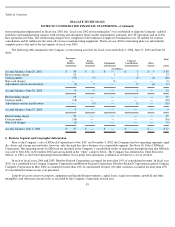

Securities and Exchange Commission’s Request for Information

In October 2003, the Company received from the SEC a request for all third-party research analyst reports regarding Seagate Technology

published during the period commencing January 1, 2000 through August 30, 2003. By early December 2003 the Company had provided all

information requested by the SEC. There are no outstanding requests from the SEC for further information. The additional information

furnished related to the allegations of the former employee who has claimed the Company terminated him in violation of the Minnesota

Whistleblower Act. Nothing has come to the Company’s attention during this process that changes its view regarding the lack of merit of those

claims. There is no procedural requirement that the SEC completes any investigation within certain timeframes or makes any announcements

with respect to the status of an investigation.

The former employee has alleged that the Company dismissed him because he asserted that the Company had incorrectly reallocated

certain expenses between costs of goods sold and research and development costs in its financial statements. The reallocations, which the

Company did record, were related to a broad company restructuring that changed the focus of activities at various locations as between

manufacturing and research and development. These reallocations had no impact on either revenues or earnings and were detailed in the

Company’s financial statements contained in its initial public offering prospectus. Moreover, the Company reviewed the reallocations, as well

as its financial statement disclosures regarding them, with its independent auditors and the members of the audit committee of its board of

directors at the time of the Company’s initial public offering in light of the employee’s allegations. Based upon the Company’s review, which

included an investigation by independent counsel and independent accountants reporting to its audit committee, the Company believes that all

reallocations were appropriate, the associated disclosure was complete, and that all of the employee’s allegations are without merit.

Environmental Matters

The Company’s operations inside and outside the United States are subject to laws and regulations relating to protection of the

environment, including those governing the discharge of pollutants into the air, soil and water, the management and disposal of hazardous

substances and wastes and clean-up of contaminated sites. Contaminants have been detected at some of the Company’

s former sites, principally

in connection with historical operations. In addition, the Company has been named as a potentially responsible party at several superfund sites.

Investigative activities have taken place at all sites of known contamination. One former site is under a Consent Order by the U.S.

Environmental Protection Agency. The extent of the contamination at this site has been investigated and defined and remediation is underway.

The Company is indemnified by a third party for a portion of the costs it may incur in the clean-up of contamination at most sites. In the

opinion of management, including internal counsel, the potential losses to the Company in excess of amounts already accrued arising out of

these matters would not have a material adverse effect on the Company’s financial position, cash flows or overall trends in results of

operations, even if joint and several liabilities were to be assessed and if the third party failed to indemnify the Company.

90