Seagate 2003 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2003 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

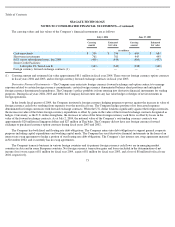

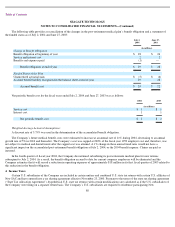

The applicable statutory rate in the Cayman Islands was zero for Seagate Technology for fiscal years ended July 2, 2004, June 27, 2003

and June 28, 2002. For purposes of the reconciliation between the provision for (benefit from) income taxes at the statutory rate and the

effective tax rate, a notional U.S. 35% rate is applied as follows:

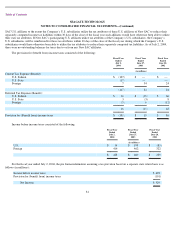

A substantial portion of the Company’s Asia Pacific manufacturing operations in China, Malaysia, Singapore and Thailand operate under

various tax holidays and tax incentive programs, which expire in whole or in part during fiscal years 2005 through 2015. Certain of the tax

holidays may be extended if specific conditions are met. The net impact of these tax holidays and tax incentive programs was to increase the

Company’s net income by approximately $89 million in fiscal year 2004 ($0.18 per share, diluted), to increase the Company’s net income by

approximately $89 million ($0.19 per share, diluted) in fiscal year 2003, and to increase the Company’s net income by approximately $74

million ($0.17 per share, diluted) in fiscal year 2002.

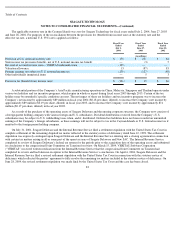

As a result of the purchase of the operating assets of Seagate Delaware and the ensuing corporate structure, the Company now consists of

a foreign parent holding company with various foreign and U.S. subsidiaries. Dividend distributions received from the Company’s U.S.

subsidiaries may be subject to U.S. withholding taxes when, and if, distributed. Deferred tax liabilities have not been recorded on unremitted

earnings of the Company’s foreign subsidiaries, as these earnings will not be subject to tax in the Cayman Islands or U.S. federal income tax if

remitted to the foreign parent holding company.

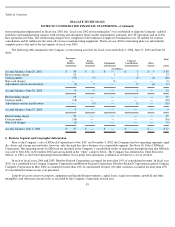

On July 31, 2001, Seagate Delaware and the Internal Revenue Service filed a settlement stipulation with the United States Tax Court in

complete settlement of the remaining disputed tax matter reflected in the statutory notice of deficiency dated June 12, 1998. The settlement

stipulation was expressly contingent upon Seagate Delaware and the Internal Revenue Service entering into a closing agreement in connection

with certain tax matters arising in all or some part of the open tax years of Seagate Delaware and New SAC. The Internal Revenue Service

completed its review of Seagate Delaware’

s federal tax returns for the periods prior to the acquisition date of the operating assets and submitted

its conclusions to the congressional Joint Committee on Taxation for review. On March 15, 2004, VERITAS Software Corporation

(“VERITAS”) received written notification from the Internal Revenue Service that the congressional Joint Committee on Taxation had

completed its review and had taken no exception to the Internal Revenue Service’s conclusions. On April 6, 2004, Seagate Delaware and the

Internal Revenue Service filed a revised settlement stipulation with the United States Tax Court in connection with the statutory notice of

deficiency which reflected the parties’ agreement to fully resolve the remaining tax matters included in the statutory notice of deficiency. On

June 28, 2004, the revised settlement stipulation was made final by the United States Tax Court and the case has been closed.

83

Fiscal Year

Ended

July 2,

2004

Fiscal Year

Ended

June 27,

2003

Fiscal Year

Ended

June 28,

2002

(in millions)

Provision at U.S. notional statutory rate

$

150

$

231

$

84

State income tax provision (benefit), net of U.S. notional income tax benefit

—

(

3

)

5

Reversal of accrued income taxes

—

VERITAS indemnification

(125

)

—

—

Valuation allowance

13

(87

)

83

Foreign earnings not subject to U.S. notional income tax

(139

)

(127

)

(89

)

Other individually immaterial items

—

5

3

Provision for (benefit from) income taxes

$

(101

)

$

19

$

86