Seagate 2003 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2003 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

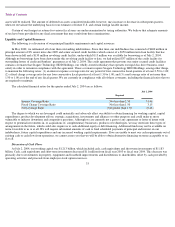

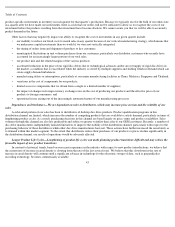

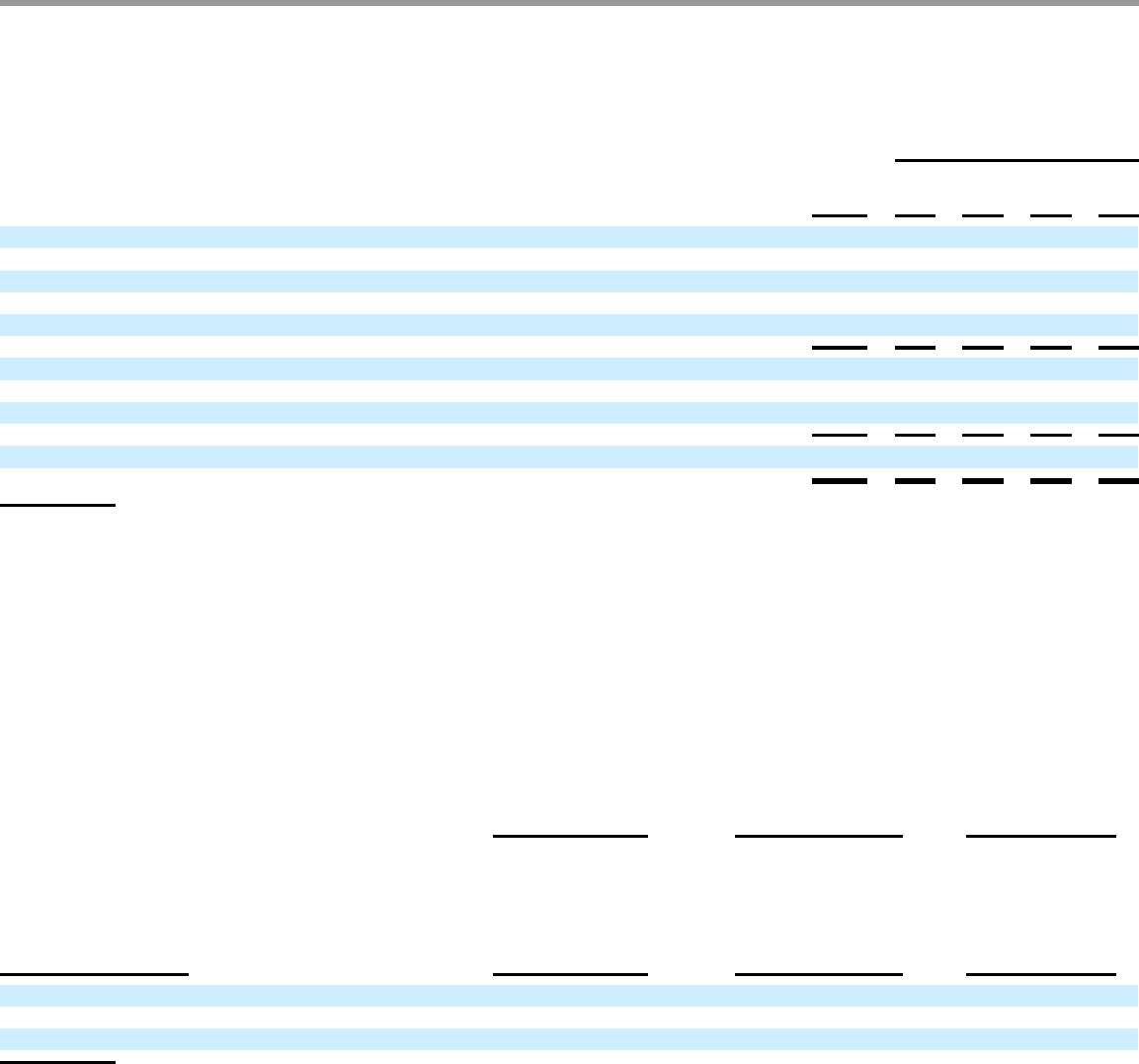

Our contractual cash obligations and commitments as of July 2, 2004 have been summarized in the table below (in millions):

Fiscal Year(s)

Total

2005

2006-

2007

2008-

2009

After

2009

Contractual Cash Obligations:

Long term debt

$

743

$

4

$

339

$

400

$

—

Capital expenditures

176

176

—

—

—

Operating leases (1)

151

15

25

9

102

Purchase obligations (2)

559

559

—

—

—

Subtotal

1,629

754

364

409

102

Commitments:

Letters of credit or bank guarantees

37

37

—

—

—

Total

$

1,666

$

791

$

364

$

409

$

102

(1)

Includes total future minimum rent expense under non-cancelable leases for both occupied and abandoned facilities (rent expense is

shown net of sublease income).

Off-Balance Sheet Arrangements

(2)

Purchase obligations are defined as contractual obligations for purchase of goods or services, which are enforceable and legally binding

on us, and that specify all significant terms.

As of July 2, 2004, we did not have any significant off-balance sheet arrangements, as defined in Item 303(a)(4)(ii) of Regulation S-K.

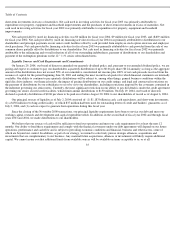

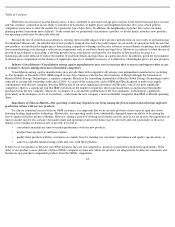

Equity Plan Compensation Information

The following table sets forth, for each of our existing equity compensation plans, the number of common shares issuable upon exercise

of outstanding options, warrants and rights, the weighted-

average exercise price of the outstanding options, warrants and rights, and the number

of common shares remaining available for issuance under such plans as of the end of fiscal year 2004.

(a)

(b)

(c)

Equity Compensation Plan

Number of Securities to

be Issued upon Exercise

of Outstanding Options,

Warrants and Rights

Weighted-Average

Exercise Price of

Outstanding Options,

Warrants and Rights

Number of Securities

Remaining Available

for Future Issuance

under Equity

Compensation Plans

(excluding securities

reflected in column (a))

Plans Approved by Shareholders

62,853,998

(1)

$6.47 per share(2)

24,034,444

(3)

Plans Not Approved by Shareholders

—

—

—

Total

62,853,998

$6.47 per share

24,034,444

(1)

This number includes 60,369,893 shares of our common stock that were subject to issuance upon the exercise of stock options granted

under our 2001 Share Option Plan, and up to 2,500,000 shares that could be purchased under our Employee Stock Purchase Plan (the

“ESPP”) in the purchase period that was in progress as of July 2, 2004. On July 30, 2004, the purchase date for that purchase period, a

total of 2,484,105 shares of our common stock were issued pursuant to the exercise of the outstanding rights under the ESPP.

36

(2)

This value is calculated based only on the exercise price of options outstanding under the 2001 Share Option Plan. The exercise price for

the rights awarded under the ESPP in the purchase period in progress on July 2, 2004 could not be determined as of July 2, 2004. On July

30, 2004, the purchase date for that purchase