Seagate 2003 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2003 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

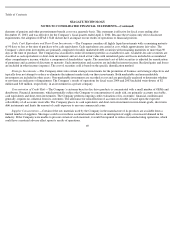

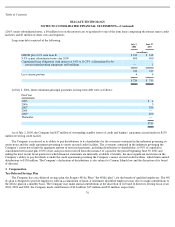

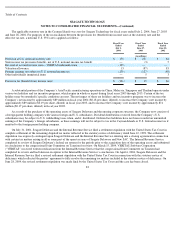

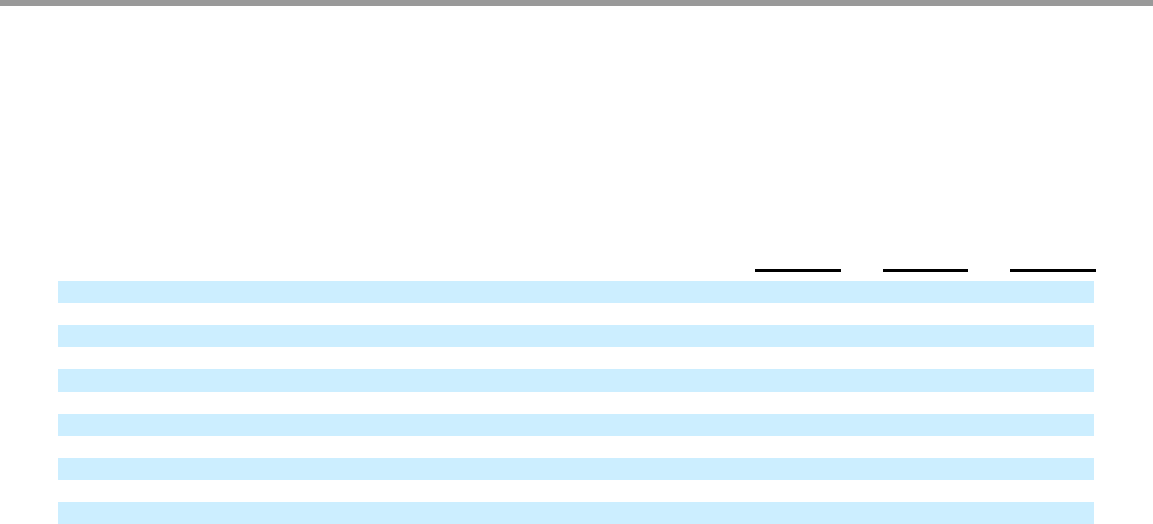

The fair value of the Company’

s stock options granted to employees during fiscal years 2004 and 2003 was estimated using the following

weighted average assumptions:

Deferred Compensation Plan

2004

Post-IPO

2003

Pre-IPO

2003

Option Plan Shares

Expected life (in years)

3.0

3.0

3.0

Risk

-

free interest rate

2.3

–

2.5%

2.1

–

3.0%

2.1

–

3.0%

Volatility

0.75

–

0.83

0.83

Minimum

Expected dividend

0.5

–

2.0%

0.7

–

1.2%

—

Fair value

$11.45

$4.80

$4.80

ESPP Plan Shares

Expected life (in years)

0.5

–

1.0

0.5

–

1.0

—

Risk

-

free interest rate

1.0

–

1.3%

1.2

–

1.3%

—

Volatility

0.45

–

0.99

0.74

–

0.91

—

Expected dividend

0.8

–

1.5%

1.2%

—

Fair value

$4.72

$3.31

—

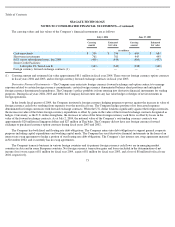

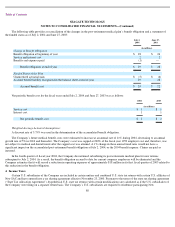

On January 1, 2001, the Company adopted a deferred compensation plan for the benefit of eligible employees. This plan is designed to

permit certain discretionary employer contributions, in excess of the tax limits applicable to the 401(k) plan and to permit employee deferrals in

excess of certain tax limits. Company assets earmarked to pay benefits under the plan are held by a rabbi trust. The Company has adopted the

provisions of Emerging Issues Task Force Issue No. 97-14, “Accounting for Deferred Compensation Arrangements Where Amounts Earned

are Held in a Rabbi Trust” (“EITF 97-14”). Under EITF 97-14, the assets and liabilities of a rabbi trust must be accounted for as if they are

assets and liabilities of the Company. In addition all earnings and expenses of the rabbi trust are recorded as other income or expense in the

Company’s financial statements. At July 2, 2004 and June 27, 2003, the deferred compensation amounts related to the rabbi trust were

approximately $61 million and $42 million, respectively, and are included in current liabilities on the accompanying balance sheets.

Post-Retirement Medical Plan

In fiscal year 2000, Seagate Delaware adopted a post-retirement medical plan that offers medical coverage to eligible U.S. retirees and

their eligible dependents. Substantially all U.S. employees become eligible for these benefits after 15 years of service and attaining age 60 and

older. The Company’s measurement date is March 31

st

of each year.

79