Seagate 2003 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2003 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

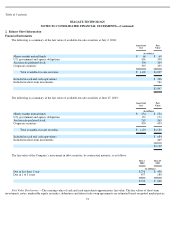

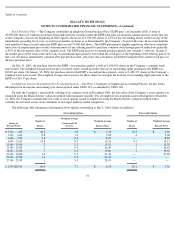

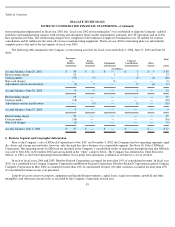

The following table provides a reconciliation of the changes in the post-retirement medical plan’s benefit obligation and a statement of

the funded status as of July 2, 2004 and June 27, 2003:

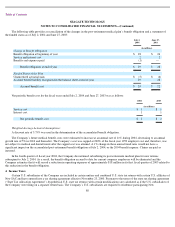

Net periodic benefit cost for the fiscal years ended July 2, 2004 and June 27, 2003 was as follows:

Weighted-Average Actuarial Assumptions:

July 2,

2004

June 27,

2003

(in millions)

Change in Benefit Obligation

Benefit obligation at beginning of year

$

28

$

26

Service and interest cost

2

2

Benefits and expenses paid

(1

)

—

Benefit obligation at end of year

$

29

$

28

Funded Status of the Plan

Unamortized actuarial gain

$

(5

)

$

(6

)

Accrued benefit liability recognized in the balance sheet at end of year

29

28

Accrued benefit cost

$

24

$

22

2004

2003

(in millions)

Service cost

$

1

$

1

Interest cost

1

1

Net periodic benefit cost

$

2

$

2

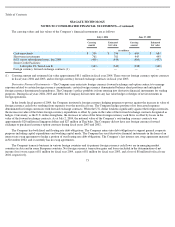

A discount rate of 5.75% was used in the determination of the accumulated benefit obligation.

The Company’s future medical benefit costs were estimated to increase at an annual rate of 11% during 2004, decreasing to an annual

growth rate of 5% in 2010 and thereafter. The Company’s cost was capped at 200% of the fiscal year 1999 employer cost and, therefore, was

not subject to medical and dental trends after the capped cost was attained. A 1% change in these annual trend rates would not have a

significant impact on the accumulated post-retirement benefit obligation at July 2, 2004, or the 2004 benefit expense. Claims are paid as

incurred.

In the fourth quarter of fiscal year 2004, the Company discontinued subsidizing its post-retirement medical plan for new retirees

subsequent to July 2, 2004. As a result, the benefit obligation accrued to date for current company employees will be eliminated and the

Company estimates that it will record a reduction in operating expenses of approximately $18 million in its first fiscal quarter of 2005 related to

this reduction in the benefit obligation.

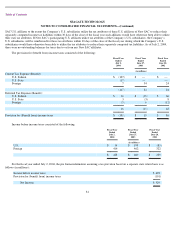

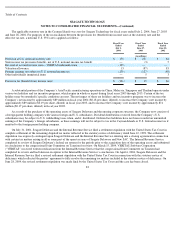

4. Income Taxes

Certain U.S. subsidiaries of the Company are included in certain unitary and combined U.S. state tax returns with certain U.S. affiliates of

New SAC and have entered into a tax sharing agreement effective November 23, 2000. Pursuant to the terms of the state tax sharing agreement

(“State Tax Allocation Agreement”), hypothetical U.S. state tax returns (with certain modifications) are calculated as if the U.S. subsidiaries of

the Company were filing on a separate return basis. The Company’s U.S. subsidiaries are required to reimburse participating New

80