Seagate 2003 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2003 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

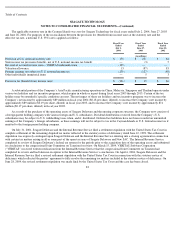

SAC U.S. affiliates to the extent the Company’s U.S. subsidiaries utilize the tax attributes of these U.S. affiliates of New SAC to reduce their

separately computed income tax liabilities within 30 days of the close of the fiscal year such affiliates would have otherwise been able to utilize

their own tax attributes. If New SAC’s participating U.S. affiliates utilize tax attributes of the Company’s U.S. subsidiaries, the Company’s

U.S. subsidiaries will be reimbursed for those tax attributes within 30 days of the close of the fiscal year during which the Company’s U.S.

subsidiaries would have otherwise been able to utilize the tax attributes to reduce their separately computed tax liabilities. As of July 2, 2004,

there were no outstanding balances for taxes due to or from any New SAC affiliates.

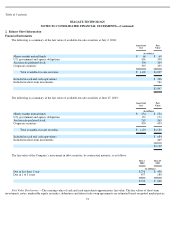

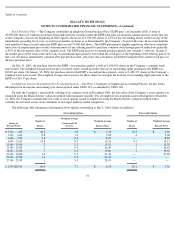

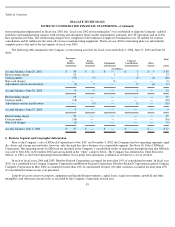

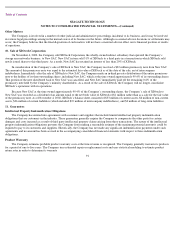

The provision for (benefit from) income taxes consisted of the following:

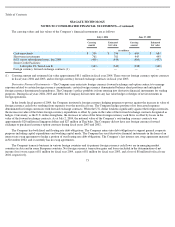

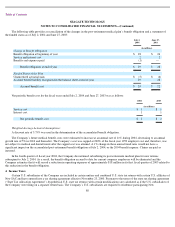

Income before income taxes consisted of the following:

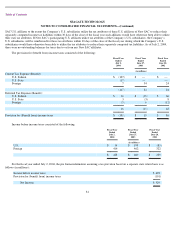

For the fiscal year ended July 2, 2004, the pro forma information assuming a tax provision based on a separate state return basis is as

follows (in millions):

81

Fiscal Year

Ended

July 2,

2004

Fiscal Year

Ended

June 27,

2003

Fiscal Year

Ended

June 28,

2002

(in millions)

Current Tax Expense (Benefit):

U.S. Federal

$

(107

)

$

—

$

—

U.S. State

(17

)

—

—

Foreign

7

34

24

(117

)

34

24

Deferred Tax Expense (Benefit):

U.S. Federal

$

16

$

(18

)

$

66

U.S. State

3

(3

)

8

Foreign

(3

)

6

(12

)

16

(15

)

62

Provision for (Benefit from) income taxes

$

(101

)

$

19

$

86

Fiscal Year

Ended

July 2,

2004

Fiscal Year

Ended

June 27,

2003

Fiscal Year

Ended

June 28,

2002

(in millions)

U.S.

$

14

$

198

$

(83

)

Foreign

414

462

322

$

428

$

660

$

239

Income before income taxes

$

428

Provision for (benefit from) income taxes

(101

)

Net Income

$

529