Seagate 2003 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2003 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

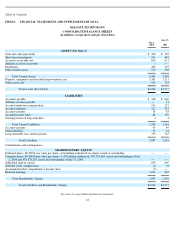

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

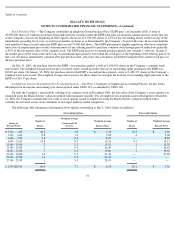

Earnings Per Share

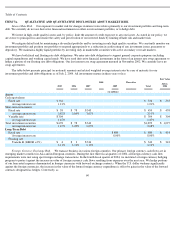

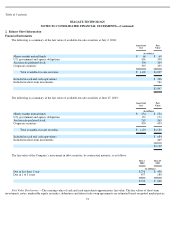

In accordance with SFAS 128, “Earnings per Share,” the following table sets forth the computation of basic and diluted net income per

share for the fiscal years ended July 2, 2004 and June 27, 2003 (in millions, except per share data):

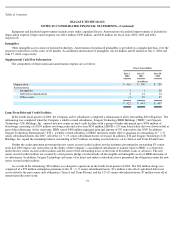

Options to purchase 3.7 million, 0.5 million and 10.8 million shares of common stock were outstanding during fiscal years 2004, 2003

and 2002, respectively, but were not included in the computation of diluted net income per share because the options’ exercise price was

greater than the average market price of the common shares and, therefore, the effect would be antidilutive.

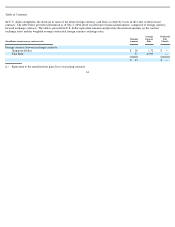

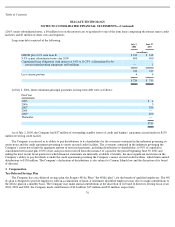

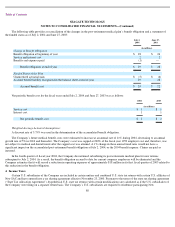

Pro Forma Effects of Stock-Based Compensation on Earnings Per Share

Fiscal Years Ended

July 2,

2004

June 27,

2003

June 28,

2002

Numerator:

Net Income

$

529

$

641

$

153

Denominator:

Denominator for basic net income per share—weighted average number of

preferred and common shares outstanding during the period

452

418

401

Incremental common shares attributable to exercise of outstanding options

46

52

27

Denominator for diluted net income per share

498

470

428

Earnings per share:

Basic

$

1.17

$

1.53

$

0.38

Diluted

$

1.06

$

1.36

$

0.36

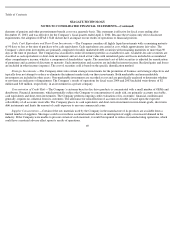

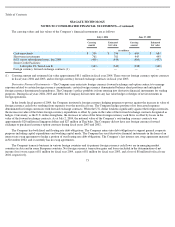

In December 2002, the FASB issued SFAS No. 148, “Accounting for Stock-Based Compensation—Transition and Disclosure” (“SFAS

148”). SFAS 148 amends SFAS No. 123, “Accounting for Stock-Based Compensation,” (“SFAS 123”) to provide alternative methods of

transition to SFAS 123’s fair value method of accounting for stock-based employee compensation. SFAS 148 also amends the disclosure

provisions of SFAS 123 and APB Opinion No. 28, “Interim Financial Reporting,” to require disclosure in the summary of significant

accounting policies of the effects of an entity’s accounting policy with respect to stock-based employee compensation on reported net income

and earnings per share in annual and interim financial statements.

70