Seagate 2003 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2003 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

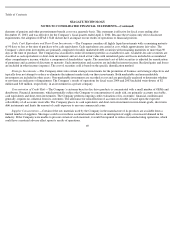

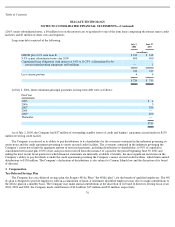

Stock-Based Benefit Plans

Share Option Plan —In December 2000, the Company’s board of directors adopted the Seagate Technology 2001 Share Option Plan (the

“Seagate Technology Option Plan”). Under the terms of the Seagate Technology Option Plan, eligible employees, directors, and consultants

can be awarded options to purchase common shares of the Company under vesting terms to be determined at the date of grant. In January 2002,

the Seagate Technology Option Plan was amended to increase the maximum number of common shares issuable under the Seagate Technology

Option Plan from 72 million to 100 million. No options to purchase the Company’s common shares had been issued through June 29, 2001.

From July 1, 2001 through July 2, 2004, options to purchase 90,985,690 common shares were granted to employees under this share option

plan, net of cancellations. Options granted to exempt employees will generally vest as follows: 25% of the shares will vest on the first

anniversary of the vesting commencement date and the remaining 75% will vest proportionately each month over the next 36 months. Options

granted to non-exempt employees will vest on the first anniversary of the vesting commencement date. Options granted under the Seagate

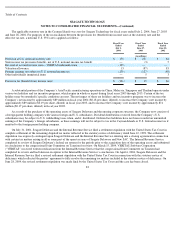

Technology Option Plan were granted at fair market value and expire ten years from the date of grant. The following is a summary of stock

option activity for the Seagate Technology Option Plan:

Options exercisable at the end of fiscal year 2004 were approximately 29,085,700 at a weighted average exercise price of $3.56. Options

exercisable at the end of fiscal year 2003 were approximately 26,545,585 at a weighted average exercise price of $2.49. Options exercisable at

the end of fiscal year 2002 were approximately 23,154,473 at a weighted average exercise price of $2.30.

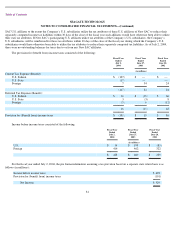

Deferred Stock Compensation —In connection with certain stock options granted in fiscal year 2003, the Company recorded deferred

stock compensation totaling $10.7 million, representing the difference between the exercise price of the options and the deemed fair value of

the Company’s common shares on the dates the options were granted. This deferred stock compensation is being amortized over the vesting

periods of the underlying stock options of 48 months. Through July 2, 2004, the Company has amortized approximately $5 million of such

compensation expense.

77

Options Outstanding

Number of

Shares

Weighted

Average Price

per Share

Shares

Available for

Future Grants

(number of shares in millions)

Balance June 29, 2001

—

—

100.0

Granted

80.5

2.73

(80.5

)

Exercised

(2.3

)

2.30

—

Cancelled

(6.2

)

2.33

6.2

Balance June 28, 2002

72.0

2.78

25.7

Granted

17.3

10.09

(17.3

)

Exercised

(12.5

)

2.38

—

Cancelled

(3.7

)

3.40

3.7

Balance June 27, 2003

73.1

4.55

12.1

Granted

4.6

22.04

(4.6

)

Exercised

(15.7

)

2.69

—

Cancelled

(1.6

)

5.70

1.6

Balance July 2, 2004

60.4

$

6.33

9.1