Salesforce.com 2012 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2012 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

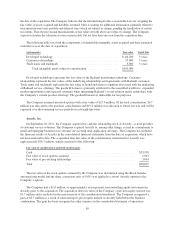

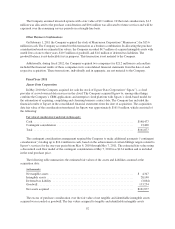

The Company assumed unvested options with a fair value of $2.1 million. Of the total consideration, $1.5

million was allocated to the purchase consideration and $0.6 million was allocated to future services and will be

expensed over the remaining service periods on a straight-line basis.

Other Business Combinations

On February 1, 2011 the Company acquired the stock of Manymoon Corporation (“Manymoon”) for $13.6

million in cash. The Company accounted for this transaction as a business combination. In allocating the purchase

consideration based on estimated fair values, the Company recorded $4.7 million of acquired intangible assets with

useful lives of one to three years, $10.5 million of goodwill, and $1.6 million of deferred tax liabilities. The

goodwill balance is not deductible for tax purposes. This transaction is not material to the Company.

Additionally, during fiscal 2012, the Company acquired two companies for $21.2 million in cash and has

included the financial results of these companies in its consolidated financial statements from the date of each

respective acquisition. These transactions, individually and in aggregate, are not material to the Company.

Fiscal Year 2011

Jigsaw Data Corporation

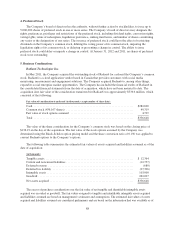

In May 2010 the Company acquired for cash the stock of Jigsaw Data Corporation (“Jigsaw”), a cloud

provider of crowd-sourced data services in the cloud. The Company acquired Jigsaw to, among other things,

combine the Company’s CRM applications and enterprise cloud platform with Jigsaw’s cloud-based model for

the automation of acquiring, completing and cleansing business contact data. The Company has included the

financial results of Jigsaw in the consolidated financial statements from the date of acquisition. The acquisition

date fair value of the consideration transferred for Jigsaw was approximately $161.9 million, which consisted of

the following:

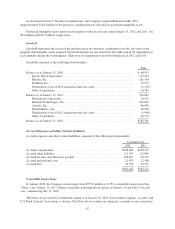

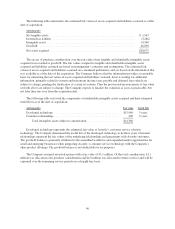

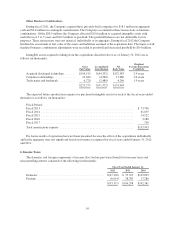

Fair value of consideration transferred (in thousands):

Cash .................................................................... $148,477

Contingent consideration .................................................... 13,400

Total .................................................................... $161,877

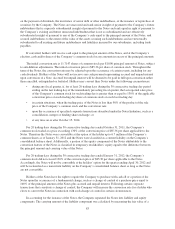

The contingent consideration arrangement required the Company to make additional payments (“contingent

consideration”) totaling up to $14.4 million in cash, based on the achievement of certain billings targets related to

Jigsaw’s services for the one-year period from May 8, 2010 through May 7, 2011. The estimated fair value using

a discounted cash flow model of the contingent consideration at May 7, 2010 was $13.4 million and is included

in the total purchase price.

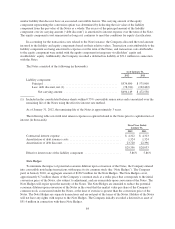

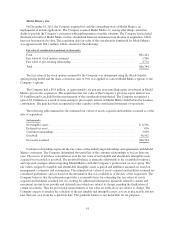

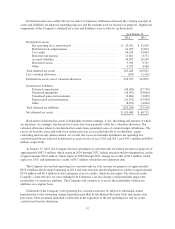

The following table summarizes the estimated fair values of the assets and liabilities assumed at the

acquisition date:

(in thousands)

Net tangible assets ......................................................... $ 4,347

Intangible assets ........................................................... 28,140

Deferred tax liability ....................................................... (3,864)

Goodwill ................................................................. 133,254

Net assets acquired ......................................................... $161,877

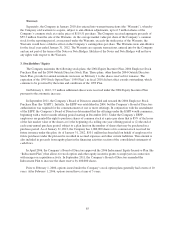

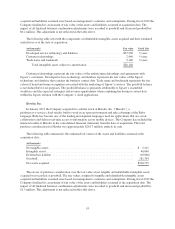

The excess of purchase consideration over the fair value of net tangible and identifiable intangible assets

acquired was recorded as goodwill. The fair values assigned to tangible and identifiable intangible assets

92