Salesforce.com 2012 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2012 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

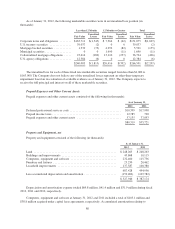

were expensed as incurred. Internal-use software is amortized on a straight line basis over its estimated useful life,

generally three years. Management evaluates the useful lives of these assets on an annual basis and tests for

impairment whenever events or changes in circumstances occur that could impact the recoverability of these assets.

The Company capitalized $27.6 million, $19.6 million, and $15.1 million of development costs during fiscal

2012, 2011 and 2010, respectively. Amortization expense totaled $15.8 million, $13.1 million and $9.9 million

during fiscal 2012, 2011 and 2010, respectively. There was no impairment of capitalized software costs during

fiscal 2012, 2011 and 2010.

Earnings/Loss Per Share

Basic earnings/loss per share attributable to salesforce.com is computed by dividing net income (loss)

attributable to salesforce.com by the weighted-average number of common shares outstanding for the fiscal

period. Diluted earnings/loss per share attributable to salesforce.com is computed giving effect to all potential

weighted average dilutive common stock, including options, restricted stock units, warrants and the convertible

senior notes. The dilutive effect of outstanding awards and convertible securities is reflected in diluted earnings

per share by application of the treasury stock method. Diluted earnings/loss per share for the fiscal year ended

January 31, 2012 is the same as basic earnings/loss per share as there is a net loss in the period and inclusion of

potentially issuable shares would be anti-dilutive.

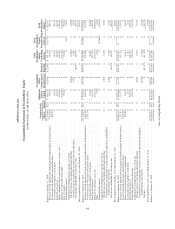

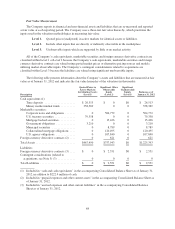

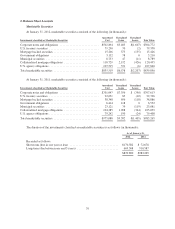

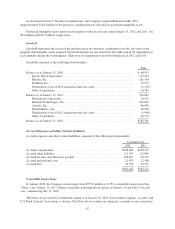

A reconciliation of the denominator used in the calculation of basic and diluted earnings/loss per share

attributable to salesforce.com is as follows (in thousands):

Fiscal Year Ended January 31,

2012 2011 2010

Numerator:

Net income (loss) attributable to salesforce.com ............. $(11,572) $ 64,474 $ 80,719

Denominator:

Weighted-average shares outstanding for basic earnings per

share ............................................. 135,302 130,222 124,462

Effect of dilutive securities:

Convertible senior notes ............................ 0 1,561 0

Employee stock awards ............................ 0 4,815 3,652

Adjusted weighted-average shares outstanding and assumed

conversions for diluted earnings per share ................ 135,302 136,598 128,114

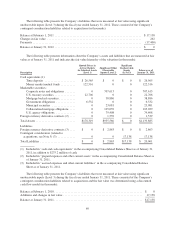

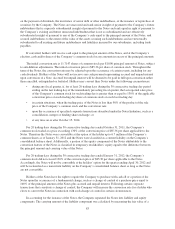

The weighted-average number of shares outstanding used in the computation of basic and diluted earnings/

loss per share does not include the effect of the following potential outstanding common stock. The effects of

these potentially outstanding shares were not included in the calculation of diluted earnings/loss per share

because the effect would have been anti-dilutive (in thousands):

Fiscal Year Ended January 31,

2012 2011 2010

Stock awards ........................................... 7,560 1,061 4,455

Warrants .............................................. 6,736 6,736 6,736

Convertible senior notes .................................. 6,735 0 0

Income Taxes

The Company uses the liability method of accounting for income taxes. Under this method, deferred tax

assets and liabilities are determined based on temporary differences between the financial statement and tax basis

of assets and liabilities and net operating loss and credit carryforwards using enacted tax rates in effect for the

year in which the differences are expected to reverse. The effect on deferred tax assets and liabilities of a change

73