Salesforce.com 2012 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2012 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In the technology industry, there is substantial and continuous competition for engineers with high levels of

experience in designing, developing and managing software and Internet-related services, as well as competition

for sales executives and operations personnel. We may not be successful in attracting and retaining qualified

personnel. We have from time to time experienced, and we expect to continue to experience, difficulty in hiring

and retaining highly skilled employees with appropriate qualifications. If we fail to attract new personnel or fail

to retain and motivate our current personnel, our business and future growth prospects could be severely harmed.

We may not realize any benefits in connection with our purchase of undeveloped land in San Francisco.

If we do not realize any benefits, our financial performance may be negatively impacted.

In November 2010, we purchased approximately 14 acres of undeveloped real estate in San Francisco,

California, including entitlements and improvements associated with the land. We may not realize any benefits

with respect to the purchase of such real estate. We have devoted significant capital resources to the purchase,

and if we develop the real estate will be required to devote substantial additional resources in the future, which

may impact our liquidity and financial flexibility. Finally, real estate assets are not as liquid as certain other types

of assets. In the event that we cease development of the real estate in the future or have a future need to sell this

property, we may not be able to do so on favorable terms, or at all, and our financial results may be negatively

impacted.

Natural disasters and other events beyond our control could materially adversely affect us.

Natural disasters or other catastrophic events may cause damage or disruption to our operations,

international commerce and the global economy, and thus could have a strong negative effect on us. Our business

operations are subject to interruption by natural disasters, fire, power shortages, pandemics and other events

beyond our control. Although we maintain crisis management and disaster response plans, such events could

make it difficult or impossible for us to deliver our services to our customers, and could decrease demand for our

services. The majority of our research and development activities, corporate headquarters, information

technology systems, and other critical business operations, are located near major seismic faults in the San

Francisco Bay Area. Because we do not carry earthquake insurance for direct quake-related losses, and

significant recovery time could be required to resume operations, our financial condition and operating results

could be materially adversely affected in the event of a major earthquake or catastrophic event.

Risks Relating to Capitalization Matters

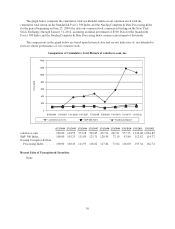

The market price of our common stock is likely to be volatile and could subject us to litigation.

The trading prices of the securities of technology companies have been highly volatile. Accordingly, the

market price of our common stock has been and is likely to continue to be subject to wide fluctuations. Factors

affecting the market price of our common stock include:

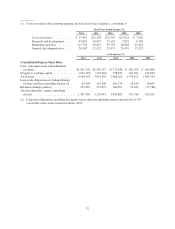

• variations in our operating results, earnings per share, cash flows from operating activities, deferred

revenue and other financial metrics and non-financial metrics, and how those results compare to

analyst expectations;

• forward looking guidance to industry and financial analysts related to future revenue and earnings per

share;

• the net increases in the number of customers, either independently or as compared with published

expectations of industry, financial or other analysts that cover our company;

• changes in the estimates of our operating results or changes in recommendations by securities analysts

that elect to follow our common stock;

• announcements of technological innovations, new services or service enhancements, strategic alliances

or significant agreements by us or by our competitors;

24