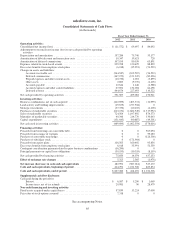

Salesforce.com 2012 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2012 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

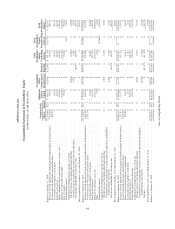

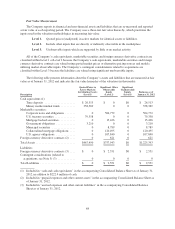

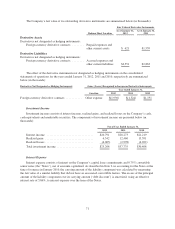

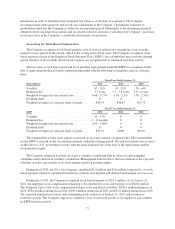

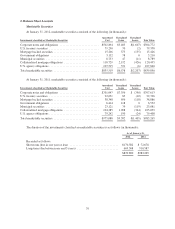

The Company’s fair value of its outstanding derivative instruments are summarized below (in thousands):

Fair Value of Derivative Instruments

Balance Sheet Location

As of January 31,

2012

As of January 31,

2011

Derivative Assets

Derivatives not designated as hedging instruments:

Foreign currency derivative contracts ........ Prepaid expenses and

other current assets $ 621 $1,539

Derivative Liabilities

Derivatives not designated as hedging instruments:

Foreign currency derivative contracts ........ Accrued expenses and

other current liabilities $2,551 $2,863

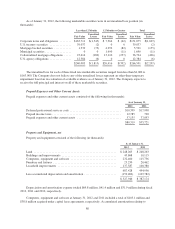

The effect of the derivative instruments not designated as hedging instruments on the consolidated

statements of operations for the years ended January 31, 2012, 2011 and 2010, respectively are summarized

below (in thousands):

Derivatives Not Designated as Hedging Instruments Gains (Losses) Recognized in Income on Derivative Instruments

Year ended January 31,

Location 2012 2011 2010

Foreign currency derivative contracts ........... Other expense $(1,930) $(1,324) $1,191

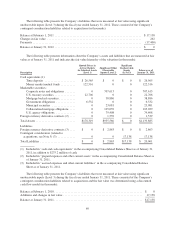

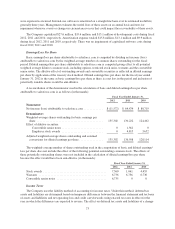

Investment Income

Investment income consists of interest income, realized gains, and realized losses on the Company’s cash,

cash equivalents and marketable securities. The components of investment income are presented below (in

thousands):

Fiscal Year Ended January 31,

2012 2011 2010

Interest income ................................ $20,791 $28,273 $21,219

Realized gains ................................. 6,542 12,460 13,391

Realized losses ................................. (4,065) (2,998) (4,202)

Total investment income ......................... $23,268 $37,735 $30,408

Interest Expense

Interest expense consists of interest on the Company’s capital lease commitments and 0.75% convertible

senior notes (the “Notes”), net of amounts capitalized. As described in Note 2, in accounting for the Notes at the

time of issuance in January 2010, the carrying amount of the liability component was calculated by measuring

the fair value of a similar liability that did not have an associated convertible feature. The excess of the principal

amount of the liability component over its carrying amount (“debt discount”) is amortized, using an effective

interest rate of 5.86%, to interest expense over the term of the Notes.

71