Salesforce.com 2012 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2012 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

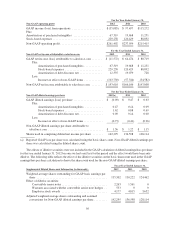

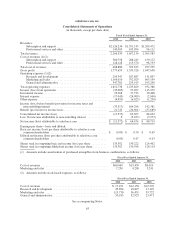

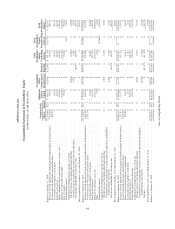

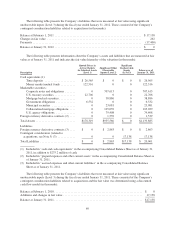

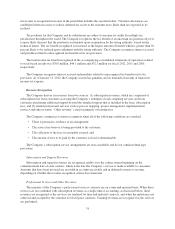

salesforce.com, inc.

Consolidated Statements of Stockholders’ Equity

(in thousands, except share data)

Common Stock Additional

Paid-in

Capital

Accumulated

Other

Comprehensive

Income/(Loss)

Retained

Earnings

Total

Stockholders’

Equity

Controlling

Interest

Total

Stockholders’

Equity

Noncontrolling

Interest

Total

Stockholders’

EquityShares Amount

Balances at January 31, 2009 .............................................122,850,062 $123 $ 648,724 $ (2,905) $ 25,842 $ 671,784 $ 10,703 $ 682,487

Exercise of stock options and stock grants to board members for board services . . . 3,472,826 4 96,153 0 0 96,157 0 96,157

Vested restricted stock units converted to shares ........................... 829,561 0 0 0 0 0 0 0

Tax benefits from employee stock plans .................................. 0 0 49,478 0 0 49,478 0 49,478

Stock-based expenses ................................................ 0 0 86,570 0 0 86,570 0 86,570

Equity component of the convertible notes issuance, net. ..................... 0 0 124,836 0 0 124,836 0 124,836

Purchase of convertible note hedges ..................................... 0 0 (126,500) 0 0 (126,500) 0 (126,500)

Sale of warrants ..................................................... 0 0 59,283 0 0 59,283 0 59,283

Noncontrolling interest ............................................... 0 0 0 0 0 0 2,161 2,161

Components of comprehensive income, net of tax:

Foreign currency translation adjustment and other ........................ 0 0 0 (2,820) 0 (2,820) 0 (2,820)

Unrealized gain on marketable securities and cash equivalents .............. 0 0 0 4,295 0 4,295 0 4,295

Net income attributable to salesforce.com ............................... 0 0 0 0 80,719 80,719 0 80,719

Total comprehensive income, year ended January 31, 2010 ..................... 0 0 0 0 0 0 0 82,194

Balances at January 31, 2010 .............................................127,152,449 $127 $ 938,544 $ (1,430) $106,561 $1,043,802 $ 12,864 $1,056,666

Exercise of stock options and stock grants to board members for board services . . . 4,697,518 5 165,494 0 0 165,499 0 165,499

Vested restricted stock units converted to shares ........................... 1,071,180 1 0 0 0 1 0 1

Tax benefits from employee stock plans .................................. 0 0 36,069 0 0 36,069 0 36,069

Stock-based expenses ................................................ 0 0 115,139 0 0 115,139 0 115,139

Purchase of subsidiary stock, net ........................................ 0 0 (156,187) 0 0 (156,187) 0 (156,187)

Other ............................................................. 0 0 (455) 0 0 (455) 0 (455)

Noncontrolling interest ............................................... 0 0 0 0 0 0 (12,864) (12,864)

Components of comprehensive income, net of tax:

Foreign currency translation adjustment and other ........................ 0 0 0 5,709 0 5,709 0 5,709

Unrealized gain on marketable securities and cash equivalents and publicly

traded strategic investments ........................................ 0 0 0 2,440 0 2,440 0 2,440

Net income attributable to salesforce.com ............................... 0 0 0 0 64,474 64,474 0 64,474

Total comprehensive income, year ended January 31, 2011 ..................... 0 0 0 0 0 0 0 72,623

Balances at January 31, 2011 .............................................132,921,147 $133 $1,098,604 $ 6,719 $171,035 $1,276,491 $ 0 $1,276,491

Exercise of stock options and stock grants to board members for board services . . . 2,517,431 3 111,779 0 0 111,782 0 111,782

Vested restricted stock units converted to shares ........................... 1,075,001 1 0 0 0 1 0 1

Shares issued related to business combinations ............................. 522,962 0 56,612 56,612 56,612

Tax benefits from employee stock plans .................................. 0 0 1,611 0 0 1,611 0 1,611

Stock-based expenses ................................................ 0 0 225,212 0 0 225,212 0 225,212

Temporary equity reclassification ....................................... 0 0 (78,741) 0 0 (78,741) 0 (78,741)

Components of comprehensive loss, net of tax:

Foreign currency translation adjustment and other ........................ 0 0 0 9,512 0 9,512 0 9,512

Unrealized loss on marketable securities and cash equivalents and publicly

traded strategic investments ........................................ 0 0 0 (3,548) 0 (3,548) 0 (3,548)

Net loss ......................................................... 0 0 0 0 (11,572) (11,572) 0 (11,572)

Total comprehensive loss, year ended January 31, 2012 ........................ 0 0 0 0 0 0 0 (5,608)

Balances at January 31, 2012 .............................................137,036,541 $137 $1,415,077 $12,683 $159,463 $1,587,360 $ 0 $1,587,360

See accompanying Notes.

64