Salesforce.com 2012 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2012 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In June 2011, the FASB issued Accounting Standards Update No. 2011-05, Comprehensive Income (Topic

220)—Presentation of Comprehensive Income (“ASU 2011-05”), to require an entity to present the total of

comprehensive income, the components of net income, and the components of other comprehensive income

either in a single continuous statement of comprehensive income or in two separate but consecutive statements.

ASU 2011-05 eliminates the option to present the components of other comprehensive income as part of the

statement of equity. ASU 2011-05 is effective for us in fiscal 2013 and should be applied retrospectively. We do

not believe the impact of the pending adoption of ASU 2011-05 will have a significant effect on the consolidated

financial statements.

Liquidity and Capital Resources

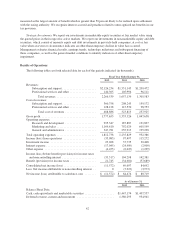

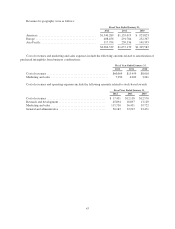

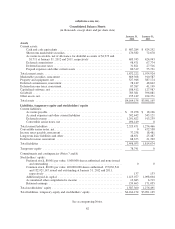

At January 31, 2012, our principal sources of liquidity were cash, cash equivalents and marketable securities

totaling $1.4 billion and accounts receivable of $683.7 million.

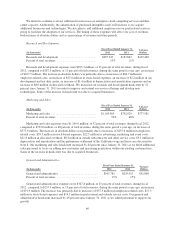

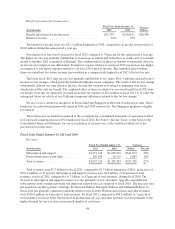

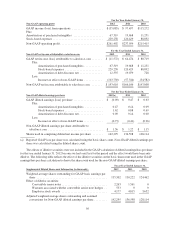

Net cash provided by operating activities was $591.5 million during fiscal 2012 and $459.1 million during

the same period a year ago. Cash provided by operating activities has historically been affected by: the amount of

net income (loss); sales of subscriptions, support and professional services; changes in working capital accounts,

particularly increases and seasonality in accounts receivable and deferred revenue as described above, the timing

of commission and bonus payments, and the timing of collections from large enterprise customers; add-backs of

non-cash expense items such as depreciation and amortization, amortization of debt discount and the expense

associated with stock-based awards.

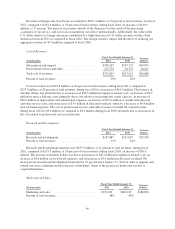

Net cash used in investing activities was $489.7 million during fiscal 2012 and $1.1 billion during the same

period a year ago. The net cash used in investing activities during fiscal 2012 primarily related to the purchase of

Model Metrics in December 2011, the purchase of Assistly in September 2011, the purchase of Radian6 in May

2011, the purchase of Manymoon in February 2011, investment of cash balances, capital expenditures and

strategic investments offset by proceeds from sales and maturities of marketable securities.

Net cash provided by financing activities was $75.9 million during fiscal 2012 and $14.1 million during the

same period a year ago. Net cash provided by financing activities during fiscal 2012 consisted primarily of $116.6

million of proceeds from equity plans and $6.0 million of excess tax benefits from employee stock plans, offset by

$30.5 million of principal payments on capital leases and $16.2 million of contingent consideration payments.

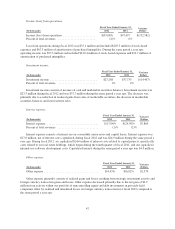

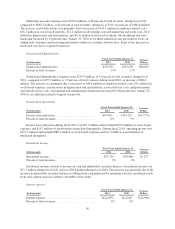

In January 2010, we issued $575.0 million of 0.75% convertible senior notes due January 15, 2015 (the

“Notes”) and concurrently entered into convertible notes hedges (the “Note Hedges”) and separate warrant

transactions (the “Warrants”). The Notes will mature on January 15, 2015, unless earlier converted.

For 20 trading days during the 30 consecutive trading days ended October 31, 2011, our common stock traded

at a price exceeding 130% of the conversion price of $85.36 per share applicable to the Notes. Accordingly, the

Notes were convertible at the holders’ option for the quarter ending January 31, 2012. The Notes are classified as a

current liability on our consolidated balance sheet so long as the Notes are convertible. Upon conversion of any

Notes, we will deliver cash up to the principal amount of the Notes and, with respect to any excess conversion value

greater than the principal amount of the Notes, shares of our common stock, cash, or a combination of both. For 20

trading days during the 30 consecutive trading days ended January 31, 2012, our common stock did not exceed

130% of the conversion price of $85.36 per share applicable to the Notes. Accordingly, the Notes will not be

convertible at the holders’ option for the quarter ending April 30, 2012 and will be reclassified as a noncurrent

liability on our consolidated balance sheet so long as the Notes are not convertible.

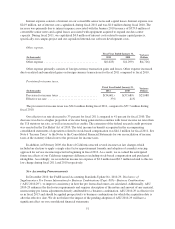

Our cash, cash equivalents and marketable securities are comprised primarily of corporate notes and

obligations, U.S. agency obligations, U.S. treasury securities, mortgage backed securities, collateralized

mortgage obligations, time deposits, money market mutual funds, government obligations and municipal

securities.

52