Salesforce.com 2012 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2012 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

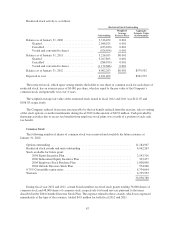

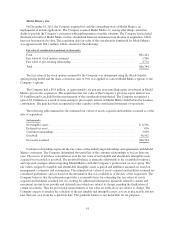

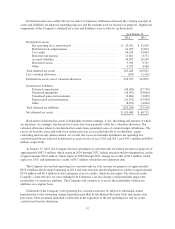

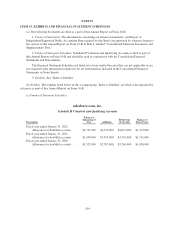

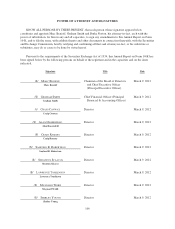

Deferred income taxes reflect the net tax effect of temporary differences between the carrying amounts of

assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. Significant

components of the Company’s deferred tax assets and liabilities were as follows (in thousands):

As of January 31,

2012 2011

Deferred tax assets:

Net operating loss carryforwards ............................... $ 35,942 $ 21,929

Deferred stock compensation .................................. 61,029 31,872

Tax credits ................................................ 54,243 39,065

Deferred rent expense ....................................... 11,661 8,371

Accrued liabilities .......................................... 49,825 29,549

Deferred revenue ........................................... 5,936 9,727

Other .................................................... 6,792 4,508

Total deferred tax assets ......................................... 225,428 145,021

Less valuation allowance ......................................... (835) (1,142)

Deferred tax assets, net of valuation allowance ........................ 224,593 143,879

Deferred tax liabilities:

Deferred commissions ....................................... (49,029) (27,739)

Purchased intangibles ........................................ (18,052) (24,856)

Unrealized gains on investments ............................... (2,881) (5,005)

Depreciation and amortization ................................. (26,352) (13,500)

Other .................................................... (8,871) (4,064)

Total deferred tax liabilities ....................................... (105,185) (75,164)

Net deferred tax assets ........................................... $119,408 $ 68,715

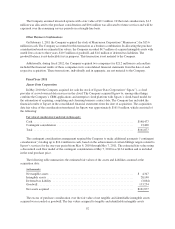

Realization of deferred tax assets is dependent on future earnings, if any, the timing and amount of which

are uncertain. Accordingly, the deferred tax assets have been partially offset by a valuation allowance. The

valuation allowance relates to net deferred tax assets from operating losses of certain foreign subsidiaries. The

excess tax benefits associated with stock option exercises are recorded directly to stockholders’ equity

controlling interest only when realized. As a result, the excess tax benefits included in net operating loss

carryforwards but not reflected in deferred tax assets for fiscal year 2012 and 2011 are $149.1 million and $80.6

million, respectively.

At January 31, 2012, the Company had net operating loss carryforwards for federal income tax purposes of

approximately $487.9 million, which expire in 2024 through 2032, federal research and development tax credits

of approximately $36.6 million, which expire in 2020 through 2032, foreign tax credits of $3.9 million, which

expires in 2019, and minimum tax credits of $0.7 million, which have no expiration date.

The Company also had net operating loss carryforwards for state income tax purposes of approximately

$319.0 million which expire beginning in 2014 and state research and development tax credits of approximately

$33.8 million and $6.5 million of state enterprise zone tax credits, which do not expire. The decrease in the

Company’s state effective tax rate resulting from California’s tax law change could potentially impact the

realizability of certain tax attributes. The Company will continue to re-assess the realizability of these tax

attributes on a regular basis.

Utilization of the Company’s net operating loss carryforwards may be subject to substantial annual

limitation due to the ownership change limitations provided by the Internal Revenue Code and similar state

provisions. Such an annual limitation could result in the expiration of the net operating loss and tax credit

carryforwards before utilization.

97