Salesforce.com 2012 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2012 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Property and Equipment

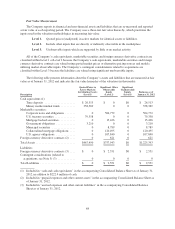

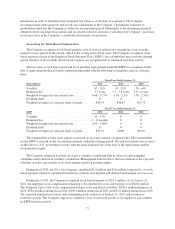

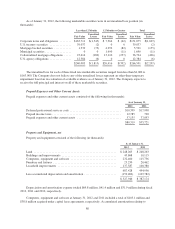

Fixed assets are stated at cost. Depreciation is calculated on a straight-line basis over the estimated useful

lives of those assets as follows:

Computers, equipment, and software ...... 3to7years

Furniture and fixtures .................. 5years

Leasehold improvements ............... Shorter of the estimated useful life or the lease term

Buildings and improvements ............ Amortized over the estimated useful lives of the

respective assets when they are ready for their

intended use.

When assets are retired, the cost and accumulated depreciation and amortization are removed from their

respective accounts and any loss on such retirement is reflected in operating expenses. When assets are otherwise

disposed of, the cost and related accumulated depreciation and amortization are removed from their respective

accounts and any gain or loss on such sale or disposal is reflected in other income (expense).

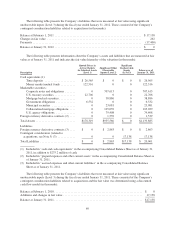

Capitalized Interest Cost

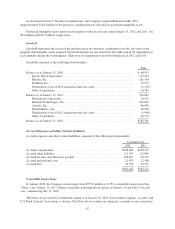

Interest costs related to major capital projects, specifically the Company’s campus project and capitalized

internal-use software development costs, are capitalized until the underlying asset is placed into service.

Capitalized interest is calculated by multiplying the effective interest rate of the Notes by the qualifying costs. As

the qualifying asset is placed into service, the qualifying asset and the related capitalized interest are amortized

over the useful life of the related asset. Interest costs of $14.1 million and $3.7 million related to the buildings

and improvements and $0.5 million and $0.3 million related to the Company’s capitalized internal-use software

development efforts were capitalized in fiscal 2012 and 2011, respectively.

Goodwill, Intangible Assets, Long-Lived Assets and Impairment Assessments

Goodwill represents the excess of the purchase price of an acquired business over the fair value of the

underlying net tangible and intangible assets. In the event that the Company determines that the carrying value of

goodwill is less than fair value, the Company will incur an impairment charge for the amount of the difference

during the quarter in which the determination is made. The Company evaluates and tests the recoverability of the

goodwill for impairment annually in the fourth quarter or more often if and when circumstances indicate that

goodwill may not be recoverable. There was no impairment of goodwill during fiscal 2012, 2011 and 2010.

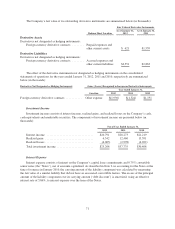

Intangible assets are amortized over their useful lives. Each period the Company evaluates the estimated

remaining useful life of its intangible assets and whether events or changes in circumstances warrant a revision to

the remaining period of amortization. The carrying amounts of these assets are periodically reviewed for

impairment whenever events or changes in circumstances indicate that the carrying value of these assets may not

be recoverable. Recoverability of these assets is measured by comparison of the carrying amount of each asset to

the future undiscounted cash flows the asset is expected to generate. In the event that the Company determines

certain assets are not fully recoverable, the Company will incur an impairment charge for those assets or portion

thereof during the quarter in which the determination is made. There was no impairment of intangible assets

during fiscal 2012, 2011 and 2010.

The Company evaluates the recoverability of its long-lived assets for possible impairment whenever events

or circumstances indicate that the carrying amount of such assets may not be recoverable. If such review

indicates that the carrying amount of long-lived assets is not recoverable, the carrying amount of such assets is

reduced to fair value. There was no impairment of long-lived assets during fiscal 2012, 2011 and 2010.

Capitalized Software Costs

The Company capitalizes costs related to its enterprise cloud computing services incurred during the

application development stage. Costs related to preliminary project activities and post implementation activities

72