Salesforce.com 2012 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2012 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

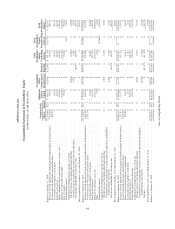

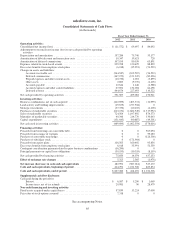

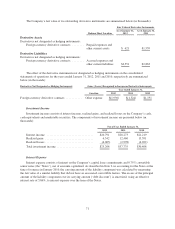

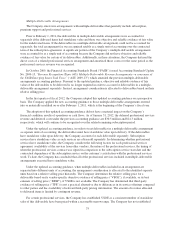

salesforce.com, inc.

Consolidated Statements of Cash Flows

(in thousands)

Fiscal Year Ended January 31,

2012 2011 2010

Operating activities:

Consolidated net income (loss) .......................................... $ (11,572) $ 69,697 $ 84,692

Adjustments to reconcile net income (loss) to net cash provided by operating

activities:

Depreciation and amortization .......................................... 157,286 75,746 53,177

Amortization of debt discount and transaction costs ......................... 10,347 19,621 728

Amortization of deferred commissions .................................... 107,195 80,159 63,891

Expenses related to stock-based awards ................................... 229,258 120,429 88,892

Excess tax benefits from employee stock plans ............................. (6,018) (35,991) (51,539)

Changes in assets and liabilities:

Accounts receivable, net ........................................... (244,947) (102,507) (54,522)

Deferred commissions ............................................. (167,199) (121,247) (82,336)

Prepaid expenses and other current assets .............................. (10,736) 2,001 (3,899)

Other assets ..................................................... 2,883 (9,770) (1,405)

Accounts payable ................................................ 12,644 1,246 (1,588)

Accrued expenses and other current liabilities .......................... 67,692 132,004 64,498

Deferred revenue ................................................. 444,674 227,693 110,322

Net cash provided by operating activities .................................. 591,507 459,081 270,911

Investing activities:

Business combinations, net of cash acquired ............................... (422,699) (403,331) (11,999)

Land activity and building improvements .................................. (19,655) (277,944) 0

Strategic investments .................................................. (37,370) (20,105) (4,400)

Purchases of marketable securities ....................................... (623,231) (1,682,549) (1,317,952)

Sales of marketable securities ........................................... 724,564 1,197,492 874,573

Maturities of marketable securities ....................................... 40,346 214,770 130,663

Capital expenditures .................................................. (151,645) (90,887) (49,501)

Net cash used in investing activities ...................................... (489,690) (1,062,554) (378,616)

Financing activities:

Proceeds from borrowings on convertible debt .............................. 0 0 567,094

Proceeds from issuance of warrants ...................................... 0 0 59,283

Purchase of convertible note hedge ....................................... 0 0 (126,500)

Purchase of subsidiary stock ............................................ 0 (171,964) 0

Proceeds from equity plans ............................................. 116,565 160,402 93,856

Excess tax benefits from employee stock plans ............................. 6,018 35,991 51,539

Contingent consideration payment related to prior business combinations ........ (16,200) 0 0

Principal payments on capital lease obligations ............................. (30,533) (10,355) (8,119)

Net cash provided by financing activities .................................. 75,850 14,074 637,153

Effect of exchange rate changes ........................................ 5,325 2,385 (1,976)

Net increase (decrease) in cash and cash equivalents ...................... 182,992 (587,014) 527,472

Cash and cash equivalents, beginning of period ........................... 424,292 1,011,306 483,834

Cash and cash equivalents, end of period ................................ $607,284 $ 424,292 $ 1,011,306

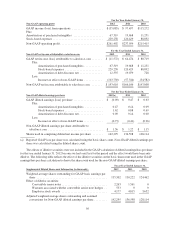

Supplemental cash flow disclosure:

Cash paid during the period for:

Interest ......................................................... $ 6,587 $ 5,290 $ 1,069

Income taxes, net of tax refunds ..................................... 20,981 90 28,479

Non-cash financing and investing activities

Fixed assets acquired under capital leases ................................. 57,839 13,224 17,000

Fair value of stock options assumed ...................................... 7,318 0 0

See accompanying Notes.

65