Salesforce.com 2012 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2012 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

•Income Tax Effects. The company’s non-GAAP effective tax rate excludes the tax effect of the expense

items described above.

We define non-GAAP gross profit as our total revenues less cost of revenues, as reported on our

consolidated statement of operations, excluding the portions of stock-based expenses and amortization of

purchased intangibles, as described above, that are included in cost of revenues.

We define non-GAAP operating profit as our gross profit less operating expenses, as reported on our

consolidated statement of operations, excluding the portions of stock-based expenses and amortization of

purchased intangibles, as described above, that are included in operating expenses.

Non-GAAP earnings per share

Management uses the non-GAAP earnings per share to provide an additional view of performance by

excluding expenses that are not directly related to performance in any particular period in the earnings per share

calculation.

We define non-GAAP earnings per share as our non-GAAP net income, which excludes the above

components, which we believe are not reflective of our ongoing operational expenses, divided by basic or diluted

shares outstanding.

Limitations on the use of Non-GAAP financial measures

A limitation of our non-GAAP financial measures of non-GAAP gross profit, non-GAAP operating profit,

non-GAAP net income and non-GAAP earnings per share is that they do not have uniform definitions. Our

definitions will likely differ from the definitions used by other companies, including peer companies, and

therefore comparability may be limited. Thus, our non-GAAP measures of non-GAAP gross profit, non-GAAP

operating profit, non-GAAP net income and non-GAAP earnings per share should be considered in addition to,

not as a substitute for, or in isolation from, measures prepared in accordance with GAAP. Additionally, in the

case of stock-based expense, if we did not pay a portion of compensation in the form of stock-based expense, the

cash salary expense included in costs of revenues and operating expenses would be higher which would affect

our cash position.

We compensate for these limitations by reconciling non-GAAP gross profit, non-GAAP operating profit,

non-GAAP net income and non-GAAP earnings per share to the most comparable GAAP financial measure.

Management encourages investors and others to review our financial information in its entirety, not to rely on

any single financial measure and to view our non-GAAP financial measures in conjunction with the most

comparable GAAP financial measures.

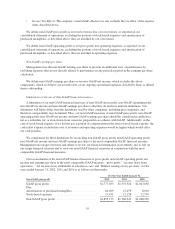

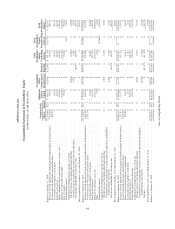

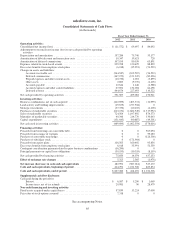

Our reconciliation of the non-GAAP financial measure of gross profit, non-GAAP operating profit, net

income and earnings per share to the most comparable GAAP measure, “gross profit,” “income (loss) from

operations,” “net income (loss) attributable to salesforce.com” and “Diluted earnings (loss) per share” for the

years ended January 31, 2012, 2011 and 2010 is as follows (in thousands):

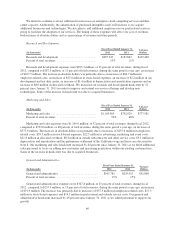

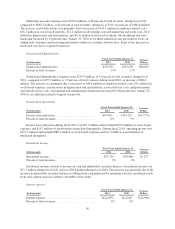

For the Year Ended January 31,

Non-GAAP gross profit 2012 2011 2010

GAAP gross profit ................................ $1,777,653 $1,333,326 $1,047,658

Plus:

Amortization of purchased intangibles ................ 60,069 15,459 8,010

Stock-based expenses ............................. 17,451 12,158 12,570

Non-GAAP gross profit ........................... $1,855,173 $1,360,943 $1,068,238

55