Salesforce.com 2012 Annual Report Download - page 78

Download and view the complete annual report

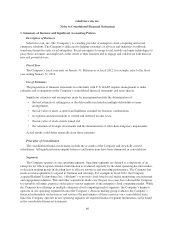

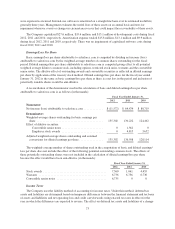

Please find page 78 of the 2012 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.in tax rates is recognized in income in the period that includes the enactment date. Valuation allowances are

established when necessary to reduce deferred tax assets to the amounts more likely than not expected to be

realized.

Tax positions for the Company and its subsidiaries are subject to income tax audits by multiple tax

jurisdictions throughout the world. The Company recognizes the tax benefit of an uncertain tax position only if it

is more likely than not that the position is sustainable upon examination by the taxing authority, based on the

technical merits. The tax benefit recognized is measured as the largest amount of benefit which is greater than 50

percent likely to be realized upon settlement with the taxing authority. The Company recognizes interest accrued

and penalties related to unrecognized tax benefits in its tax provision.

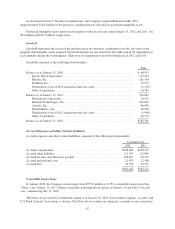

The total income tax benefit recognized in the accompanying consolidated statements of operations related

to stock-based awards was $76.0 million, $44.1 million and $32.1 million for fiscal 2012, 2011 and 2010,

respectively.

The Company recognizes interest accrued and penalties related to unrecognized tax benefits in its tax

provision. As of January 31, 2012, the Company accrued no penalties and an immaterial amount of interest in

income tax expense.

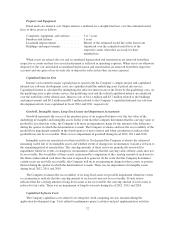

Revenue Recognition

The Company derives its revenues from two sources: (1) subscription revenues, which are comprised of

subscription fees from customers accessing the Company’s enterprise cloud computing services and from

customers purchasing additional support beyond the standard support that is included in the basic subscription

fees; and (2) related professional services such as process mapping, project management, implementation

services and other revenue. “Other revenue” consists primarily of training fees.

The Company commences revenue recognition when all of the following conditions are satisfied:

• There is persuasive evidence of an arrangement;

• The service has been or is being provided to the customer;

• The collection of the fees is reasonably assured; and

• The amount of fees to be paid by the customer is fixed or determinable.

The Company’s subscription service arrangements are non-cancelable and do not contain refund-type

provisions.

Subscription and Support Revenues

Subscription and support revenues are recognized ratably over the contract terms beginning on the

commencement date of each contract, which is the date the Company’s service is made available to customers.

Amounts that have been invoiced are recorded in accounts receivable and in deferred revenue or revenue,

depending on whether the revenue recognition criteria have been met.

Professional Services and Other Revenues

The majority of the Company’s professional services contracts are on a time and material basis. When these

services are not combined with subscription revenues as a single unit of accounting, as discussed below, these

revenues are recognized as the services are rendered for time and material contracts, and when the milestones are

achieved and accepted by the customer for fixed price contracts. Training revenues are recognized as the services

are performed.

74