Rite Aid 2012 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2012 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended March 3, 2012, February 26, 2011 and February 27, 2010

(In thousands, except per share amounts)

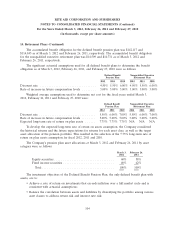

13. Stock Option and Stock Award Plans (Continued)

available for granting of restricted stock, stock options, phantom stock, stock bonus awards and other

equity based awards at the discretion of the Board of Directors. The adoption of the 2006 Omnibus

Equity Plan became effective upon the closing of the Acquisition.

In June 2010, the stockholders of Rite Aid Corporation approved the adoption of the Rite Aid

Corporation 2010 Omnibus Equity Plan. Under the plan, 35,000 shares of Rite Aid common stock are

available for granting of restricted stock, stock options, phantom stock, stock bonus awards and other

equity based awards at the discretion of the Board of Directors. The adoption of the 2010 Omnibus

Equity Plan became effective on June 23, 2010.

All of the plans provide for the Board of Directors (or at its election, the Compensation

Committee) to determine both when and in what manner options may be exercised; however, it may

not be more than 10 years from the date of grant. All of the plans provide that stock options may be

granted at prices that are not less than the fair market value of a share of common stock on the date

of grant. The aggregate number of shares authorized for issuance for all plans is 89,446 as of March 3,

2012.

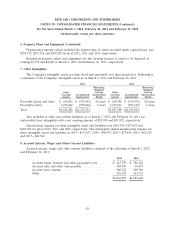

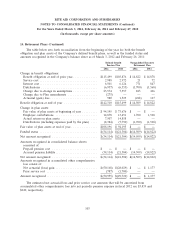

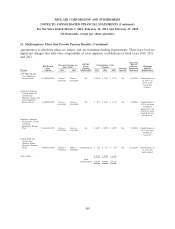

Stock Options

The Company determines the fair value of stock options issued on the date of grant using the

Black-Scholes-Merton option-pricing model. The following weighted average assumptions were used for

options granted in fiscal 2012, 2011 and 2010:

2012 2011 2010

Expected stock price volatility(1) ............ 79% 79% 76%

Expected dividend yield(2) ................. 0.00% 0.00% 0.00%

Risk-free interest rate(3) .................. 1.45% 1.92% 2.50%

Expected option life(4) ................... 5.5 years 5.5 years 5.5 years

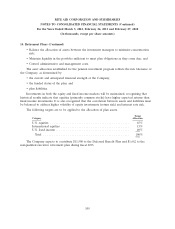

(1) The expected volatility is based on the historical volatility of the stock price over the most

recent period equal to expected life of the option.

(2) The dividend rate that will be paid out on the underlying shares during the expected term

of the options. The Company does not pay dividends on its common stock, as such, the

dividend rate will always be zero percent.

(3) The risk free interest rate is equal to the rate available on United States Treasury

zero-coupon issues as of the grant date of the option with a remaining term equal to the

expected term.

(4) The period of time for which the option is expected to be outstanding. The Company

analyzed employees for exercise behavior.

98