Rite Aid 2012 Annual Report Download - page 75

Download and view the complete annual report

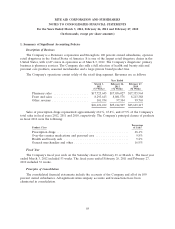

Please find page 75 of the 2012 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended March 3, 2012, February 26, 2011 and February 27, 2010

(In thousands, except per share amounts)

1. Summary of Significant Accounting Policies (Continued)

Certain Business Risks and Management’s Plans

The U.S. economy is currently in a continued downturn and the future economic environment may

not fully recover to levels prior to the downturn. The Company is highly leveraged and its substantial

indebtedness could limit cash flow available for operations and could adversely affect its ability to

service debt or obtain additional financing. As a result of the current condition of the credit markets,

the Company may not be able to obtain additional financing on favorable terms, or at all. If the

Company’s operating results, cash flow or capital resources prove inadequate, or if interest rates rise

significantly, the Company could face substantial liquidity problems and might be required to dispose of

material assets or operations to meet its debt and other obligations or otherwise be required to delay

its planned activities.

Management believes that the Company has adequate sources of liquidity to meet its anticipated

requirements for working capital, debt service and capital expenditures through fiscal 2013. The

Company has a $1,175,000 senior secured revolving credit facility of which $136,000 was outstanding at

March 3, 2012.

Derivatives

The Company may enter into interest rate swap agreements to hedge the exposure to increasing

rates with respect to its variable rate debt, when the Company deems it prudent to do so. Upon

inception of interest rate swap agreements, or modifications thereto, the Company performs a

comprehensive review of the interest rate swap agreements based on the criteria as provided by

ASC 815, ‘‘Derivatives and Hedging.’’ As of March 3, 2012 and February 26, 2011, the Company had

no interest rate swap arrangements or other derivatives.

Discontinued Operations

For purposes of determining discontinued operations, the Company has determined that the store

level is a component of the entity within the context of ASC 360, ‘‘Property, Plant and Equipment.’’ A

component of an entity comprises operations and cash flows that can be clearly distinguished,

operationally and for financial reporting purposes, from the rest of the Company. The Company

routinely evaluates its store base and closes non-performing stores. The Company evaluates the results

of operations of these closed stores both quantitatively and qualitatively to determine if it is

appropriate for reporting as discontinued operations. Stores sold where the Company retains the

prescription files are excluded from the analysis as the Company retains direct cash flows resulting

from the migration of revenue to existing stores.

Recent Accounting Pronouncements

In September 2011, the Financial Accounting Standards Board (‘‘FASB’’) issued an amendment

related to multiemployer pension plans. This amendment increases the quantitative and qualitative

disclosures about an employer’s participation in individually significant multiemployer plans that offer

pension and other postretirement benefits. The guidance is effective for fiscal years ended after

December 15, 2011. The Company has adopted the guidance and modified the disclosures surrounding

our participation in multiemployer plans in Note 15, Multiemployer Plans that Provide Benefits.

75