Rite Aid 2012 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2012 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

proceeds of certain asset dispositions (at the option of the noteholder) and include limitations on our

ability to pay dividends, make investments or other restricted payments, incur debt, grant liens, sell

assets and enter into sale-leaseback transactions. The 9.75% senior secured notes due June 2016 were

issued at 98.2% of par.

Off Balance Sheet Obligations

Until October 26, 2009, we maintained securitization agreements (the ‘‘First Lien Facility’’) with

several multi-seller asset-backed commercial paper vehicles (‘‘CPVs’’). Under the terms of the First

Lien Facility, we sold substantially all of our eligible third party pharmaceutical receivables to a

bankruptcy remote Special Purpose Entity (‘‘SPE’’) and retained servicing responsibility. The SPE then

transferred an interest in these receivables to various CPVs. We also maintained a $225.0 million

second priority accounts receivable securitization term loan (‘‘Second Lien Facility’’).

On October 26, 2009, we terminated both accounts receivable securitization facilities and replaced

them with senior secured notes, increased borrowing capacity under our existing senior secured

revolving credit facility and an increase in borrowings under our Tranche 4 Term Loan. As part of this

refinancing, we incurred a prepayment penalty of $2.3 million in relation to the Second Lien Facility

and recognized $3.8 million of unamortized discount related to the Second Lien Facility. These charges

were recorded as a component of selling, general, and administrative expenses.

As of March 3, 2012, we had no material off balance sheet arrangements, other than operating

leases included in the table below.

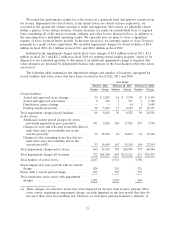

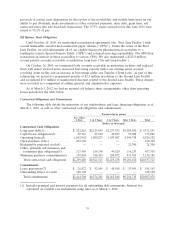

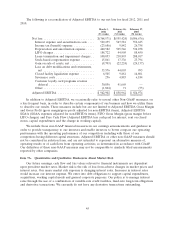

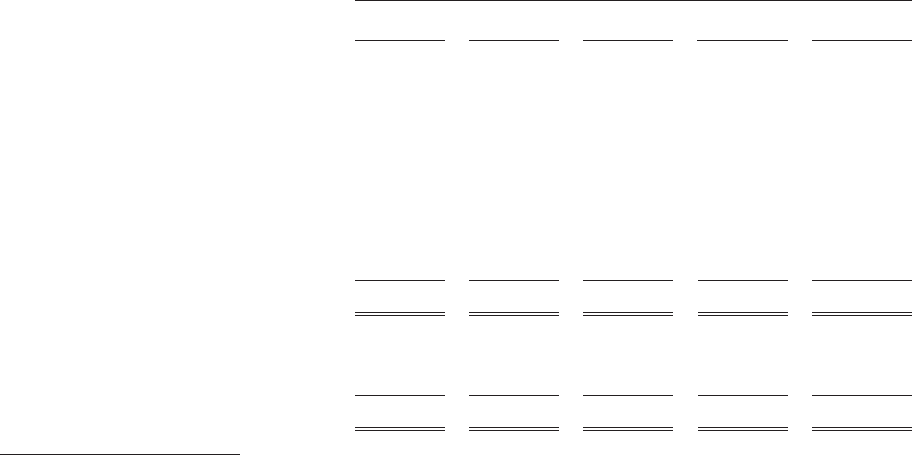

Contractual Obligations and Commitments

The following table details the maturities of our indebtedness and lease financing obligations as of

March 3, 2012, as well as other contractual cash obligations and commitments.

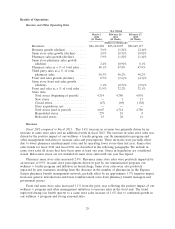

Payment due by period

Less Than

1 Year 1 to 3 Years 3 to 5 Years After 5 Years Total

(Dollars in thousands)

Contractual Cash Obligations

Long term debt(1) .............. $ 522,824 $2,125,045 $2,237,702 $4,285,670 $ 9,171,241

Capital lease obligations(2) ........ 30,716 43,560 40,897 59,908 175,081

Operating leases(3) ............. 1,002,062 1,880,275 1,639,047 4,304,798 8,826,182

Open purchase orders ........... 432,340 — — — 432,340

Redeemable preferred stock(4) .....———21,300 21,300

Other, primarily self insurance and

retirement plan obligations(5) .... 117,450 154,190 49,520 116,233 437,393

Minimum purchase commitments(6) . 153,894 318,455 248,072 413,765 1,134,186

Total contractual cash obligations . $2,259,286 $4,521,525 $4,215,238 $9,201,674 $20,197,723

Commitments

Lease guarantees(7) ............. $ 26,832 $ 52,680 $ 48,610 $ 53,041 $ 181,163

Outstanding letters of credit ....... 128,190 — — — 128,190

Total commitments ............ $2,414,308 $4,574,205 $4,263,848 $9,254,715 $20,507,076

(1) Includes principal and interest payments for all outstanding debt instruments. Interest was

calculated on variable rate instruments using rates as of March 3, 2012.

39