Rite Aid 2012 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2012 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended March 3, 2012, February 26, 2011 and February 27, 2010

(In thousands, except per share amounts)

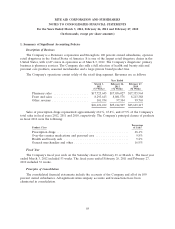

1. Summary of Significant Accounting Policies (Continued)

In June 2011, the FASB issued an amendment related to statements of comprehensive income.

This amendment requires an entity to present the total of comprehensive income, the components of

net income, and the components of other comprehensive income in either a single continuous

statement of comprehensive income or in two separate but consecutive statements. This amended

guidance eliminates the option to present the components of other comprehensive income as part of

the statement of changes in stockholders’ equity. In December 2011, the FASB issued another

amendment related to statements of comprehensive income. The Company will adopt this guidance in

fiscal 2013.

In May 2011, the FASB issued an amendment to revise certain fair value measurement and

disclosure requirements. This amendment establishes common requirements for measuring fair value

and for disclosing information about fair value measurements in accordance with U.S. GAAP and

International Financial Reporting Standards. These changes are effective for interim and annual

periods beginning after December 15, 2011 on a prospective basis. Early adoption is not permitted. We

do not expect the adoption of this standard to have a material effect on our financial results.

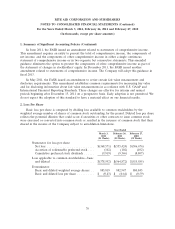

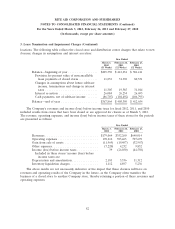

2. Loss Per Share

Basic loss per share is computed by dividing loss available to common stockholders by the

weighted average number of shares of common stock outstanding for the period. Diluted loss per share

reflects the potential dilution that could occur if securities or other contracts to issue common stock

were exercised or converted into common stock or resulted in the issuance of common stock that then

shared in the income of the Company subject to anti-dilution limitations.

Year Ended

March 3, February 26, February 27,

2012 2011 2010

(53 Weeks) (52 Weeks) (52 Weeks)

Numerator for loss per share:

Net loss ........................... $(368,571) $(555,424) $(506,676)

Accretion of redeemable preferred stock .... (102) (102) (102)

Cumulative preferred stock dividends ...... (9,919) (9,346) (8,807)

Loss applicable to common stockholders—basic

and diluted ......................... $(378,592) $(564,872) $(515,585)

Denominator:

Basic and diluted weighted average shares . . 885,819 882,947 880,843

Basic and diluted loss per share .......... $ (0.43) $ (0.64) $ (0.59)

76