Rite Aid 2012 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2012 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended March 3, 2012, February 26, 2011 and February 27, 2010

(In thousands, except per share amounts)

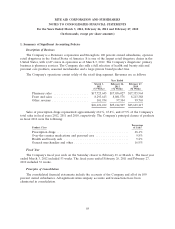

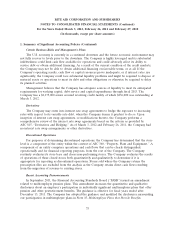

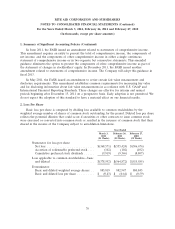

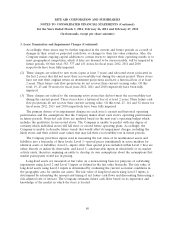

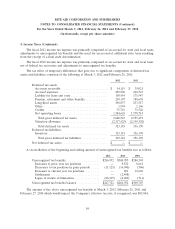

2. Loss Per Share (Continued)

Due to their antidilutive effect, the following potential common shares have been excluded from

the computation of diluted loss per share as of March 3, 2012, February 26, 2011 and February 27,

2010:

Year Ended

March 3, February 26, February 27,

2012 2011 2010

(53 Weeks) (52 Weeks) (52 Weeks)

Stock options ......................... 73,798 74,298 76,114

Convertible preferred stock ............... 31,195 29,391 27,692

Convertible debt ....................... 24,800 24,800 61,045

129,793 128,489 164,851

Also excluded from the computation of diluted loss per share as of March 3, 2012, February 26,

2011 and February 27, 2010 are restricted shares and restricted stock units of 11,506, 7,078, and 5,944

which are included in shares outstanding.

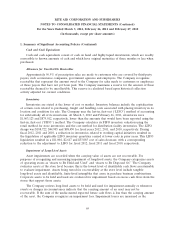

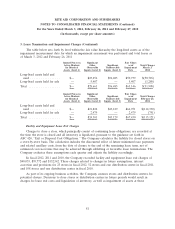

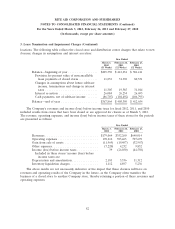

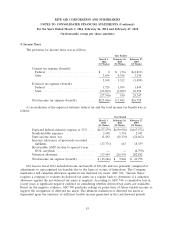

3. Lease Termination and Impairment Charges

Impairment Charges

The Company evaluates long-lived assets for impairment whenever events or changes in

circumstances indicate that an asset group has a carrying value that may not be recoverable. The

individual operating store is the lowest level for which cash flows are identifiable. As such, the

Company evaluates individual stores for recoverability. To determine if a store needs to be tested for

recoverability, the Company considers items such as decreases in market prices, changes in the manner

in which the store is being used or physical condition, changes in legal factors or business climate, an

accumulation of losses significantly in excess of budget, a current period operating or cash flow loss

combined with a history of operating or cash flow losses or a projection of continuing losses, or an

expectation that the store will be closed or sold.

The Company monitors new and recently relocated stores against operational projections and

other strategic factors such as regional economics, new competitive entries and other local market

considerations to determine if an impairment evaluation is required. For other stores, it performs a

recoverability analysis if it has experienced current-period and historical cash flow losses.

In performing the recoverability test, the Company compares the expected future cash flows of a

store to the carrying amount of its assets. Significant judgment is used to estimate future cash flows.

Major assumptions that contribute to its future cash flow projections include expected sales, gross profit,

and distribution expenses; expected costs such as payroll, occupancy costs and advertising expenses; and

estimates for other significant selling, and general and administrative expenses. Many long-term macro-

economic and industry factors are considered, both quantitatively and qualitatively, in the future cash flow

assumptions. In addition to current and expected economic conditions such as inflation, interest and

unemployment rates that affect customer shopping patterns, the Company considers that it operates in a

highly competitive industry which includes the actions of other national and regional drugstore chains,

77