Rite Aid 2012 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2012 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We review key performance results for active stores on a quarterly basis and approve certain stores

for closure. Impairment for closed stores, if any (many stores are closed on lease expiration), are

recorded in the quarter the closure decision is made and approved. Most stores are physically closed

within a quarter of the closure decision. Closure decisions are made on an individual store or regional

basis considering all of the macro-economic, industry and other factors discussed above, in addition to,

the operating store’s individual operating results. We currently have no plans to close a significant

number of active stores in future periods. In the next fiscal year, we currently expect to close 50 stores,

primarily as a result of lease expirations. We recorded impairment charges for closed facilities of $8.6

million in fiscal 2012, $6.1 million in fiscal 2011 and $26.6 million in fiscal 2010.

Included in the impairment charges noted above were charges of $5.9 million in fiscal 2012, $2.4

million in fiscal 2011 and $12.3 million in fiscal 2010 for existing owned surplus property. Assets to be

disposed of are evaluated quarterly to determine if an additional impairment charge is required. Fair

value estimates are provided by independent brokers who operate in the local markets where the assets

are located.

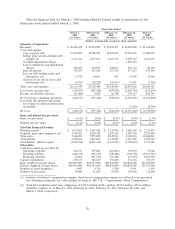

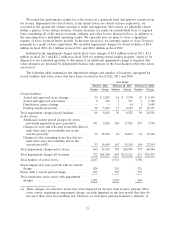

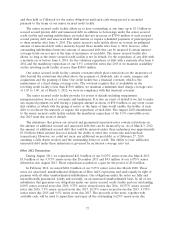

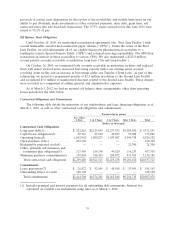

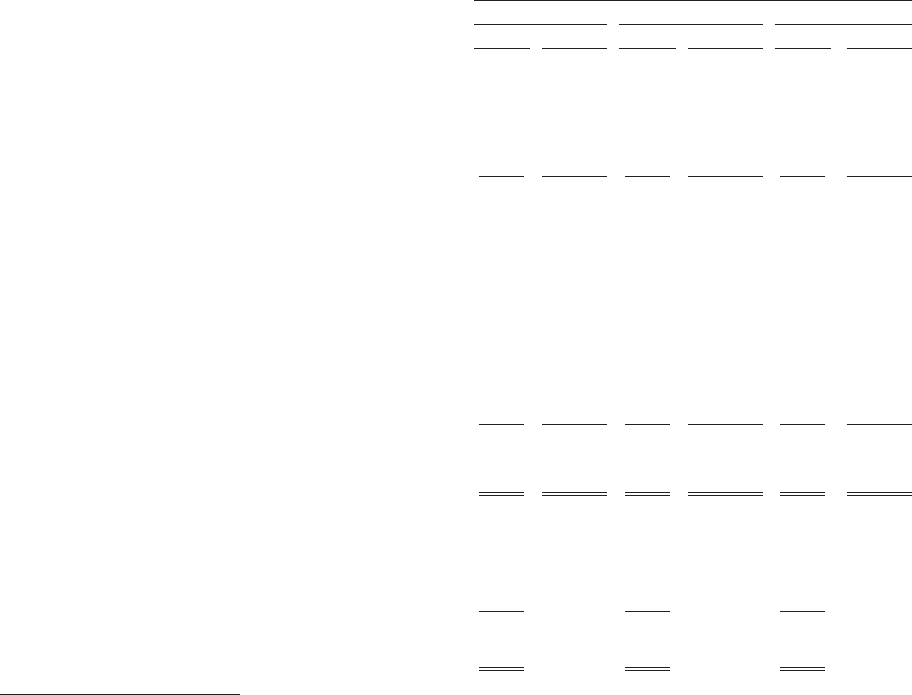

The following table summarizes the impairment charges and number of locations, segregated by

closed facilities and active stores that have been recorded in fiscal 2012, 2011 and 2010:

Year Ended

March 3, 2012 February 26, 2011 February 27, 2010

Number Charge Number Charge Number Charge

Closed facilities:

Actual and approved store closings ........... 55 $ 2,283 51 $ 3,278 67 $ 5,479

Actual and approved relocations ............. 2 499 1 317 7 3,108

Distribution center closings ................. — — 1 94 1 5,689

Existing surplus properties ................. 12 5,863 17 2,433 23 12,315

Total impairment charges-closed facilities ........ 69 8,645 70 6,122 98 26,591

Active stores:

Additional current period charges for stores

previously impaired in prior periods(1) ....... 591 9,822 584 17,825 437 7,710

Charges for new and relocated stores that did not

meet their asset recoverability test in the

current period(2) ...................... 19 18,926 44 36,015 32 17,260

Charges for the remaining stores that did not

meet their asset recoverability test in the

current period(3) ...................... 53 14,605 167 55,159 104 23,914

Total impairment charges-active stores .......... 663 43,353 795 108,999 573 48,884

Total impairment charges-all locations ........... 732 $51,998 865 $115,121 671 $75,475

Total number of active stores ................. 4,667 4,714 4,780

Stores impaired in prior periods with no current

charge ................................ 428 263 321

Stores with a current period charge ............ 663 795 573

Total cumulative active stores with impairment

charges ............................... 1,091 1,058 894

(1) These charges are related to stores that were impaired for the first time in prior periods. Most

active stores, requiring an impairment charge, are fully impaired in the first period that they do

not meet their asset recoverability test. However, in each prior period presented, a minority of

33