Rite Aid 2012 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2012 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended March 3, 2012, February 26, 2011 and February 27, 2010

(In thousands, except per share amounts)

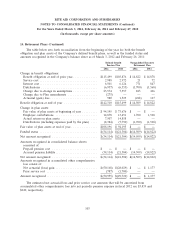

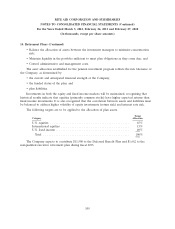

14. Retirement Plans (Continued)

The accumulated benefit obligation for the defined benefit pension plan was $142,117 and

$114,845 as of March 3, 2012 and February 26, 2011, respectively. The accumulated benefit obligation

for the nonqualified executive retirement plan was $14,509 and $14,731 as of March 3, 2012 and

February 26, 2011, respectively.

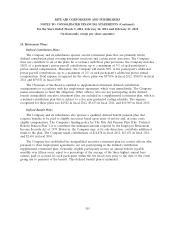

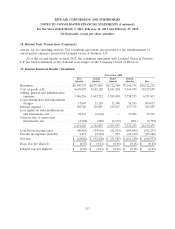

The significant actuarial assumptions used for all defined benefit plans to determine the benefit

obligation as of March 3, 2012, February 26, 2011, and February 27, 2010 were as follows:

Defined Benefit Nonqualified Executive

Pension Plan Retirement Plan

2012 2011 2010 2012 2011 2010

Discount rate ................................ 4.50% 5.50% 6.00% 4.50% 5.50% 6.00%

Rate of increase in future compensation levels ........ 5.00% 5.00% 5.00% 3.00% 3.00% 3.00%

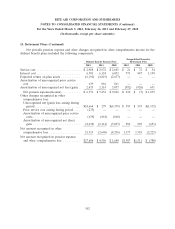

Weighted average assumptions used to determine net cost for the fiscal years ended March 3,

2012, February 26, 2011 and February 27, 2010 were:

Defined Benefit Nonqualified Executive

Pension Plan Retirement Plan

2012 2011 2010 2012 2011 2010

Discount rate ................................ 5.50% 6.00% 7.00% 5.50% 6.00% 7.00%

Rate of increase in future compensation levels ........ 5.00% 5.00% 5.00% 3.00% 3.00% 3.00%

Expected long-term rate of return on plan assets ...... 7.75% 7.75% 7.75% N/A N/A N/A

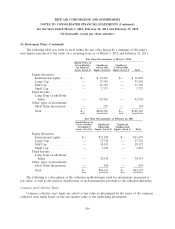

To develop the expected long-term rate of return on assets assumption, the Company considered

the historical returns and the future expectations for returns for each asset class, as well as the target

asset allocation of the pension portfolio. This resulted in the selection of the 7.75% long-term rate of

return on plan assets assumption for fiscal 2012, 2011 and 2010.

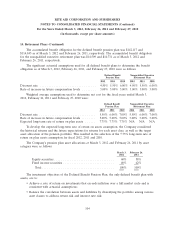

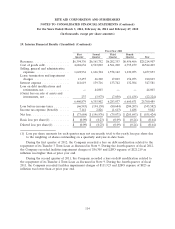

The Company’s pension plan asset allocations at March 3, 2012 and February 26, 2011 by asset

category were as follows:

March 3, February 26,

2012 2011

Equity securities .................................. 60% 58%

Fixed income securities ............................. 40% 42%

Total ......................................... 100% 100%

The investment objectives of the Defined Benefit Pension Plan, the only defined benefit plan with

assets, are to:

• Achieve a rate of return on investments that exceeds inflation over a full market cycle and is

consistent with actuarial assumptions;

• Balance the correlation between assets and liabilities by diversifying the portfolio among various

asset classes to address return risk and interest rate risk;

104