Rite Aid 2012 Annual Report Download - page 40

Download and view the complete annual report

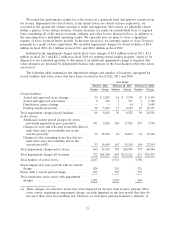

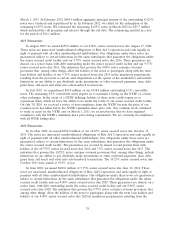

Please find page 40 of the 2012 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(2) Represents the minimum lease payments on non-cancelable leases, including interest, but net of

sublease income.

(3) Represents the minimum lease payments on non-cancelable leases, including interest, but net of

sublease income.

(4) Represents value of redeemable preferred stock at its redemption date.

(5) Includes the undiscounted payments for self-insured medical coverage, actuarially determined

undiscounted payments for self-insured workers’ compensation and general liability, and actuarially

determined obligations for defined benefit pension and nonqualified executive retirement plans.

(6) Represents commitments to purchase products and licensing fees from certain vendors.

(7) Represents lease guarantee obligations for 123 former stores related to certain business

dispositions. The respective purchasers assume the obligations and are, therefore, primarily liable

for these obligations.

Obligations for income tax uncertainties pursuant to ASC 740, ‘‘Income Taxes’’ of approximately

$83.8 million are not included in the table above as we are uncertain as to if or when such amounts

may be settled.

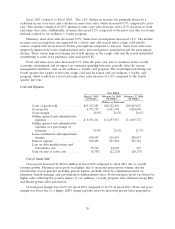

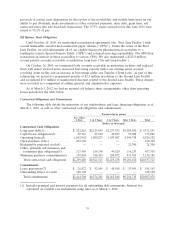

Net Cash Provided By (Used In) Operating, Investing and Financing Activities

Cash flow provided by operating activities was $266.5 million in fiscal 2012. Cash flow was

positively impacted by the reduction in net loss, an increase in accounts payable due to the timing of

purchases partially offset by an increase in inventory resulting primarily from price inflation and

increased store inventory to support sales growth.

Cash flow provided by operating activities was $395.8 million in fiscal 2011. Cash flow was

positively impacted by a reduction in inventory and an increase in accounts payable due to the timing

of purchases. Additionally, the reductions in accounts receivable were no longer offset by repayments to

the receivables securitization facility which was eliminated in the third quarter of fiscal 2010.

Cash flow used in operating activities was $325.1 million in fiscal 2010. Cash flow was negatively

impacted by the repayments of the accounts receivable securitization facilities totaling $555.0 million

and a decrease in accounts payable offset by a reduction in inventory and accounts receivable. The

decreases in accounts receivables, inventory and accounts payable were due to operating fewer stores

and various working capital initiatives.

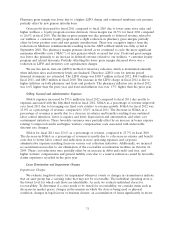

Cash used in investing activities was $221.2 million in fiscal 2012. Cash was used for the purchase

of property, plant and equipment and prescription files which was partially offset by proceeds from

asset dispositions and sale-leaseback transactions.

Cash used in investing activities was $156.7 million in fiscal 2011. Cash was used for the purchase

of property, plant and equipment and prescription files which was partially offset by proceeds from

asset dispositions.

Cash used in investing activities was $120.5 million in fiscal 2010. Cash was used for the purchase

of property, plant and equipment and prescription files which was offset in part by proceeds from asset

dispositions.

Cash provided by financing activities was $25.8 million in fiscal 2012 and was primarily due to

increased revolver borrowings coupled with the February 2012 issuance of $481.0 million of our 9.25%

senior notes due March 15, 2020 and concurrent repurchase of $404.8 million of our 8.625% senior

notes due March 2015. The remaining $54.2 million of the 8.625% senior notes due March 2015 were

repurchased in March 2012.

40