Rite Aid 2012 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2012 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended March 3, 2012, February 26, 2011 and February 27, 2010

(In thousands, except per share amounts)

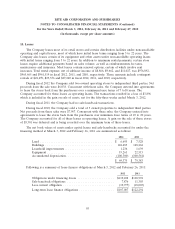

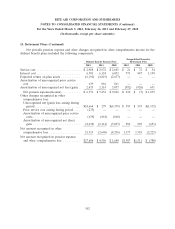

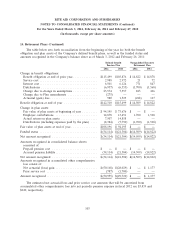

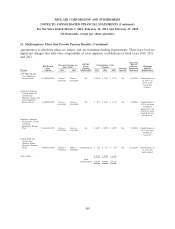

14. Retirement Plans (Continued)

Net periodic pension expense and other changes recognized in other comprehensive income for the

defined benefit plans included the following components:

Nonqualified Executive

Defined Benefit Pension Plan Retirement Plan

2012 2011 2010 2012 2011 2010

Service cost ......................... $ 2,988 $ 2,972 $ 2,603 $ 21 $ 72 $ 54

Interest cost ......................... 6,501 6,124 6,032 771 847 1,130

Expected return on plan assets ........... (6,192) (4,819) (2,637) — — —

Amortization of unrecognized prior service

cost ............................. 639 861 861 — — —

Amortization of unrecognized net loss (gain) . 2,435 2,114 3,037 (582) (926) 651

Net pension expense(income) .......... $ 6,371 $ 7,252 $ 9,896 $ 210 $ (7) $ 1,835

Other changes recognized in other

comprehensive loss:

Unrecognized net (gain) loss arising during

period .......................... $24,664 $ 279 $(4,339) $ 595 $ 593 $(1,572)

Prior service cost arising during period .... (275) — — — — —

Amortization of unrecognized prior service

costs ........................... (639) (861) (860) — — —

Amortization of unrecognized net (loss)

gain ........................... (2,435) (2,114) (3,037) 582 925 (651)

Net amount recognized in other

comprehensive loss .................. 21,315 (2,696) (8,236) 1,177 1,518 (2,223)

Net amount recognized in pension expense

and other comprehensive loss .......... $27,686 $ 4,556 $ 1,660 $1,387 $1,511 $ (388)

102