Office Depot 2010 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2010 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

related to impairment of certain software applications. In the fourth quarter of 2010 it was determined that the

company was no longer going to fund the continued development of this software and the software projects were

abandoned. The charge is presented in Other asset impairments on the Consolidated Statements of Operations.

Other charges recognized during 2010 have been included in Division operating profit or corporate general and

administrative expenses, as appropriate.

The company expects to take additional actions during the coming years in an effort to increase efficiency and

operating results. These actions could include combining, outsourcing or eliminating functions which could lead

to additional charges when the relevant accounting criteria are met. These actions are still being considered.

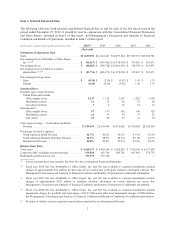

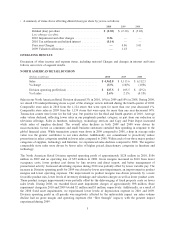

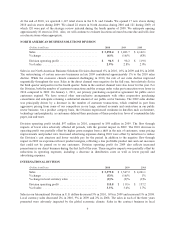

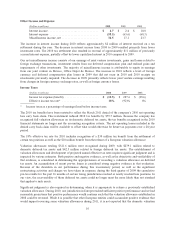

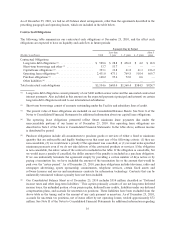

A summary of the Charges recognized during 2009 and 2008 and the line item presentation of these amounts in

our accompanying Consolidated Statements of Operations is as follows.

(Dollars in millions, except per share amounts) 2009 2008

Cost of goods sold and occupancy costs ................................ $ 13 $ 16

Store and warehouse operating and selling expenses ...................... 188 52

Goodwill and trade name impairments ................................. — 1,270

Other asset impairments ............................................ 26 114

General and administrative expenses .................................. 26 17

Total pre-tax Charges ............................................ 253 1,469

Income tax effect .................................................. (19) (103)

After-tax impact ................................................ $ 234 $ 1,366

Per share impact .................................................. $ 0.86 $ 5.01

Of the $253 million of 2009 Charges, approximately $194 million either have or are expected to require cash

settlement, including longer-term lease obligations that will require cash over multi-year lease terms.

The primary components of Charges include:

•Goodwill and Trade Name Impairments — During 2008, we recorded non-cash Charges of $1.2 billion to

write down goodwill and $57 million related to the impairment of trade names. Our recoverability assessment

of these non-amortizing intangible assets considered company-specific projections, assumptions about market

participant views and the company’s overall market capitalization around the testing period.

•Retail Store Initiatives — As part of the strategic review, we closed 126 stores in North America (six of which

were closed in the fourth quarter of 2008 and the remainder in 2009) and 27 stores in Japan. The stores closed

were underperforming or stores that were no longer a strategic fit for the company. The Charges totaled $122

million and $104 million in 2009 and 2008, respectively. The 2009 Charges were primarily related to lease

accruals, inventory write downs, severance expenses and other facility closure costs. The 2008 Charges related

primarily to asset impairments, inventory write downs and lease accruals.

•Supply Chain Initiatives — During 2009, we closed five DCs and six crossdock facilities in North America

and consolidated our DCs in Europe. Charges related to these actions totaled approximately $57 million in

2009 and related primarily to lease accruals, inventory write downs, severance expenses and other facility

closure costs. The 2008 Charges totaled approximately $22 million and consisted primarily of accelerated

depreciation, severance related costs and lease accruals.

•Asset Sales and Sale-Leaseback Transactions — As a result of the strategic review and to enhance liquidity,

we entered into multiple sale and sale-leaseback transactions. Total proceeds from these transactions were

approximately $150 million and are included in the investing section on our Consolidated Statement of Cash

Flows. Losses on these transactions are included in the Charges and totaled approximately $22 million in

2009. Gains have been deferred and will reduce rent expense over the related leaseback periods.

8