Office Depot 2010 Annual Report Download - page 2

Download and view the complete annual report

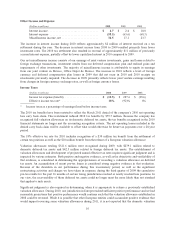

Please find page 2 of the 2010 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.OFFICE DEPOT, INC.

FORM 10-K/A

EXPLANATORY NOTE

This Amendment No. 1 to the annual report of Office Depot, Inc. on Form 10-K/A (“Form 10-K/A”) amends our

annual report on Form 10-K for the year ended December 25, 2010, which was originally filed on February 22,

2011 (“Original Form 10-K”). This amendment is being filed for the purpose of restating certain amounts in the

Selected Financial Data in Item 6, Management’s Discussion and Analysis of Financial Condition and Results of

Operations in Item 7, Financial Statements in Item 8 and Controls and Procedures in Item 9A.

The company’s 2010 financial statements included in the Original Form 10-K were prepared reflecting the

expected carry back of certain net operating losses. The company’s position was based on its view, after

consultation with its tax advisor, that its tax losses qualified for extended carry-back provisions enacted in 2009.

That position resulted in the company recognizing a tax benefit of approximately $80 million in the 2010

statement of operations. The company filed its carry back claim in February 2011 and in March 2011, the claim

was denied by the Internal Revenue Service. Because the company has recognized full valuation allowances on

its domestic deferred tax assets, the tax benefits recognized in the 2010 financial statements no longer met the

accounting recognition criteria. The net operating losses included in the denied carry back claim will be available

to offset what would otherwise be future tax payments over a 20-year period.

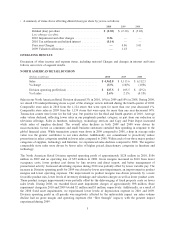

The impact of correcting that error is to reduce previously recorded full year tax benefits by approximately $79.5

million, change net earnings for 2010 from $33.3 million to a net loss of $46.2 million, increase the net loss

attributable to common shareholders from $2.2 million to $81.7 million and increase loss per share from $0.01 to

$0.30. Additionally, the current tax receivable of approximately $63 million has been removed from the balance

sheet at December 25, 2010. The impact to quarterly periods is a reduction in diluted earnings per share of $0.02

in the quarter ended June 26, 2010, and $0.06 in the quarter ended September 25, 2010 as compared to amounts

previously reported.

These restatements relate to non-cash entries in the 2010 financial statements and the reduction in net earnings

has been offset in the consolidated statement of cash flows by a change in working capital and other items. This

change in tax position, however, reduces the company’s outlook of projected 2011 cash flow from operations by

eliminating the corresponding tax receivable.

The Form 10-K/A also reflects a correction to the 2010 presentation of approximately $22 million of acquisition-

related payments from investing activities to financing activities in the consolidated statement of cash flows.

The restatement is more fully described in Note B to the Notes to Consolidated Financial Statements.

Pursuant to the rules of the SEC, Item 15, Part IV has also been amended to contain the currently dated

certifications from the company’s principal executive officer and principal financial officer as required by

Section 302 and 906 of the Sarbanes-Oxley Act of 2002. The certifications of the Company’s principal executive

officer and principal financial officer are attached to this Amended Filing as Exhibits 31.1, 31.2, and 32.

This Form 10-K/A does not reflect events occurring after the filing of the Original Form 10-K, other than the

restatement for the matter discussed above. Concurrent with the Form 10-K/A, the company will file amended

Forms 10-Q for the second and third quarters of 2010.

1