Office Depot 2010 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2010 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

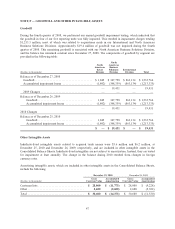

Other asset impairments

In addition to the exit costs discussed above, during 2008, we recognized other material charges because of the

downturn in our business. Those charges include goodwill and trade name impairment charges, as well as

material asset impairments relating to stores and charges to impair amortizing customer relationship intangible

assets.

We perform our annual review of goodwill and other non-amortizing intangible assets during the fourth quarter.

As a result of this review for 2008, we recorded non-cash charges of $1,213 million to write down goodwill and

$57 million related to the impairment of trade names. Our recoverability assessment of these non-amortizing

intangible assets considered company-specific projections, assumptions about market participant views and the

company’s overall market capitalization around the testing period.

At least annually, we review our stores for possible impairment. Our impairment analysis is based on a cash flow

model at the individual store level, beginning with recent store performance and forecasting the anticipated future

results based on chain-wide and individual store initiatives. If the anticipated undiscounted cash flows of a store

cannot support the carrying amount of the store’s assets, an impairment charge to bring the assets to estimated

fair value is recorded to operations as a component of store and warehouse operating and selling expenses.

Because of the downturn in our business in late 2008, we recorded store asset impairment charges totaling

approximately $98 million in 2008. Store impairment charges totaled approximately $2 million and $3 million in

2010 and 2009, respectively.

We review our amortizing intangible assets at least annually to determine whether events and circumstances

warrant a revision to the remaining period of amortization. In developing forecasts for our assessment of

goodwill in 2008, we concluded that the value of certain amortizing intangible assets was impaired. Accordingly,

during 2008, we incurred a charge of approximately $11 million to fully impair the customer list intangible assets

in our International Division.

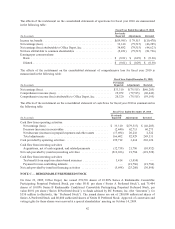

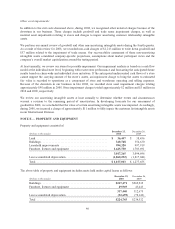

NOTE E — PROPERTY AND EQUIPMENT

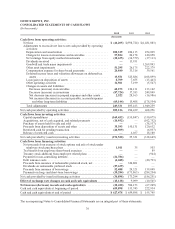

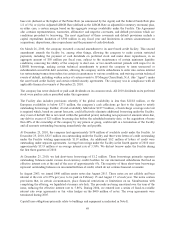

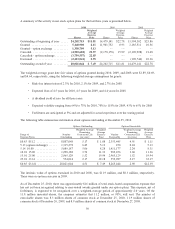

Property and equipment consisted of:

(Dollars in thousands)

December 25,

2010

December 26,

2009

Land ................................................ $ 36,447 $ 38,456

Buildings ............................................. 340,748 354,630

Leasehold improvements ................................ 994,320 997,919

Furniture, fixtures and equipment ......................... 1,645,750 1,703,691

3,017,265 3,094,696

Less accumulated depreciation ............................ (1,860,252) (1,817,041)

Total ................................................ $ 1,157,013 $ 1,277,655

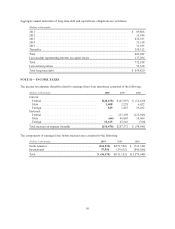

The above table of property and equipment includes assets held under capital leases as follows:

(Dollars in thousands)

December 25,

2010

December 26,

2009

Buildings ............................................... $267,471 $269,232

Furniture, fixtures and equipment ........................... 49,969 43,443

317,440 312,675

Less accumulated depreciation .............................. (92,695) (78,143)

Total .................................................. $224,745 $234,532

46