Office Depot 2010 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2010 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

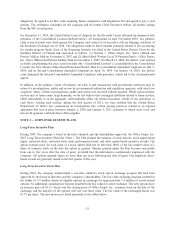

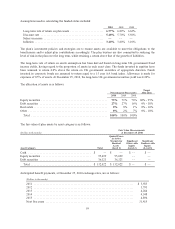

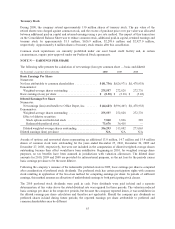

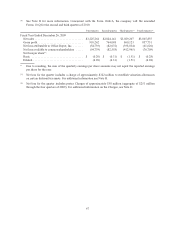

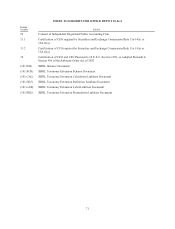

A reconciliation of the measure of Division operating profit to consolidated earnings from continuing operations

before income taxes follows.

(Dollars in thousands) 2010 2009 2008

Division operating profit ............................ $334,759 $ 323,309 $ 247,777

(Add)/subtract:

Charges (see Note D) ............................... —253,383 1,468,684

Unallocated general, administrative and corporate expenses

(excluding Charges) .............................. 372,050 334,931 324,134

Interest expense ................................... 58,498 65,628 68,286

Interest income .................................... (4,663) (2,396) (10,013)

Miscellaneous income, net ........................... (34,451) (17,085) (23,666)

Earnings (loss) before income taxes .................... $ (56,675) $(311,152) $(1,579,648)

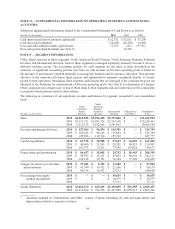

As of December 25, 2010, we sold to customers in 53 countries throughout North America, Europe, Asia and

Latin America. We operate wholly-owned entities, majority-owned entities or participate in other ventures

covering 41 countries and have alliances in an additional 12 countries. There is no single country outside of the

United States in which we generate 10% or more of our total revenues. Geographic financial information relating

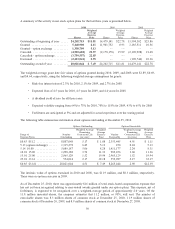

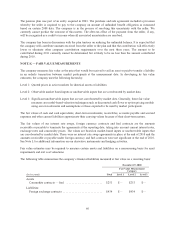

to our business is as follows (in thousands).

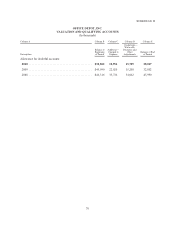

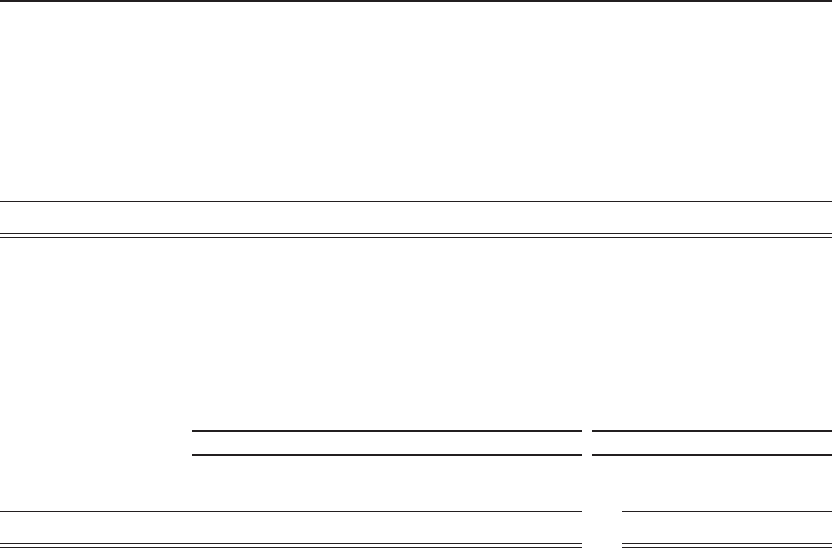

Sales Property and Equipment

2010 2009 2008 2010 2009

United States ........ $ 8,189,642 $ 8,476,404 $10,083,984 $ 980,426 $1,059,236

International ........ 3,443,452 3,668,063 4,411,560 176,587 218,419

Total ............ $11,633,094 $12,144,467 $14,495,544 $1,157,013 $1,277,655

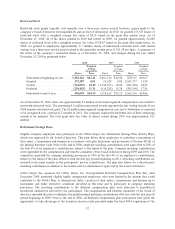

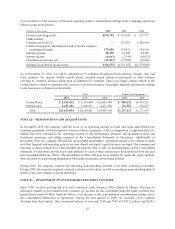

NOTE Q — DISPOSITIONS AND ACQUISITIONS

In December 2010, the company sold the stock of its operating entities in Israel and Japan and entered into

licensing agreements with the respective buyers of those companies. A loss on disposition of approximately $11

million has been reflected in the operating income of the International Division and included in store and

warehouse operating and selling expenses in the Consolidated Statement of Operations. Additionally in

December 2010, the company entered into an amended shareholders’ agreement related to its venture in India

such that financial and operating policies are now shared and equity capital balances are equal. The revenues and

expenses of these entities have been included through the date of sale or deconsolidation in the Consolidated

Statement of Operations and the assets and liabilities of each of these entities have been removed from the year

end Consolidated Balance Sheet. The investment in India will now be accounted for under the equity method,

with our share of results being presented in Miscellaneous income, net in future periods.

During 2010, the company acquired the remaining noncontrolling interests of an entity operating in Sweden.

During 2008, the company acquired a majority interest in that entity, as well as remaining noncontrolling interest

shares of our joint ventures in Israel and China.

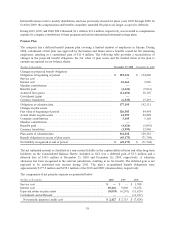

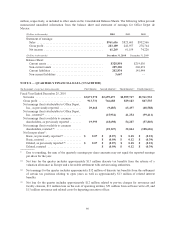

NOTE R — INVESTMENT IN UNCONSOLIDATED JOINT VENTURE

Since 1994, we have participated in a joint venture in Latin America, Office Depot de Mexico. Because we

participate equally in this business with a partner, we account for this investment using the equity method. Our

proportionate share of Office Depot de Mexico’s net income or loss is presented in miscellaneous income, net in

the Consolidated Statements of Operations. During the first quarter of 2009, we received a $13.9 million

dividend from this venture. Our investment balance at year end 2010 and 2009 of $205.8 million and $168.6

65