Office Depot 2010 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2010 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

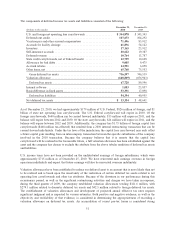

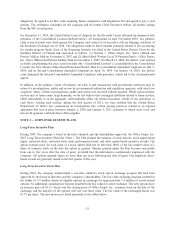

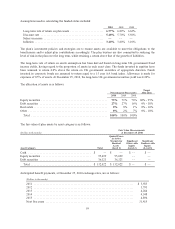

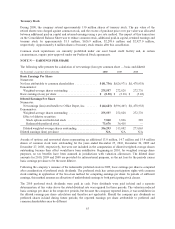

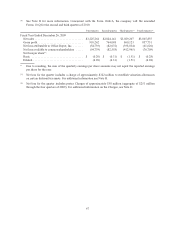

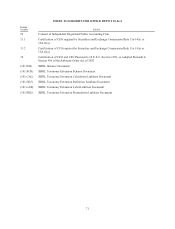

The company records its senior notes payable at par value, adjusted for amortization of a fair value hedge which

was cancelled in 2005. The fair value of the senior notes indicated in the following table was determined based

on quoted market prices.

2010 2009

(In thousands)

Carrying

Value

Fair

Value

Carrying

Value

Fair

Value

$400 million senior notes ................... $400,067 $398,000 $400,172 $345,966

There were no significant differences between the carrying values and fair values of our financial instruments as

of December 25, 2010 and December 26, 2009, except as disclosed above.

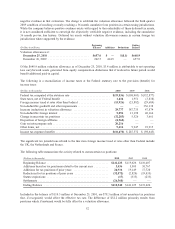

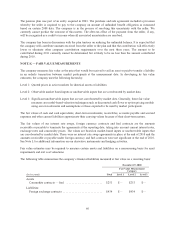

NOTE L — DERIVATIVE INSTRUMENTS AND HEDGING

As a global supplier of office products and services we are exposed to risks associated with changes in foreign

currency exchange rates, commodity prices and interest rates. Our foreign operations are typically, but not

exclusively, conducted in the currency of the local environment. We are exposed to the risk of foreign currency

exchange rate changes when we make purchases, sell products, or arrange financings that are denominated in a

currency different from the entity’s functional currency. Depending on the settlement timeframe and other

factors, we may enter into foreign currency derivative transactions to mitigate those risks. We may designate and

account for such qualifying arrangements as hedges. Gains and losses on these cash flow hedging transactions are

deferred in OCI and recognized in earnings in the same period as the hedged item. Transactions that are not

designated as cash flow hedges are marked to market at each period with changes in value included in earnings.

Historically, we have not entered into transactions to hedge our net investment in foreign operations but may in

future periods.

We also are exposed to the risk of changing fuel prices from inbound and outbound transportation arrangements.

The structure of many of these transportation arrangements, however, precludes applying hedge accounting. In

those circumstances, we may enter into derivative transactions to offset the risk of commodity price changes, and

the value of the derivative contract is marked to market at each reporting period with changes recognized in

earnings. To the extent fuel arrangements qualify for hedge accounting, gains and losses are deferred in OCI until

such time as the hedged item impacts earnings. At the end of the 2010, the company had entered into contracts

for approximately 9.6 million gallons of fuel that will be settled monthly through December 2011.

Interest rate changes on our obligations may result from external market factors, as well as changes in our credit

rating. We manage our exposure to interest rate risks at the corporate level. Interest rate sensitive assets and

liabilities are monitored and assessed for market risk. Currently, no interest rate related derivative arrangements

are in place. At December 25, 2010 and December 26, 2009, OCI included the deferred gain from a hedge

contract terminated in a prior period. This deferral is being amortized to interest expense through 2013.

In certain markets, we may contract with third parties for our future energy needs. Such arrangements are not

considered derivatives because they are within the ordinary course of business and are for physical delivery.

Accordingly, these arrangements are not included in the tables below.

Financial instruments authorized under the company’s established risk management policy include spot trades,

swaps, options, caps, collars, forwards and futures. Use of derivative financial instruments for speculative

purposes is expressly prohibited.

61