Office Depot 2010 Annual Report Download - page 56

Download and view the complete annual report

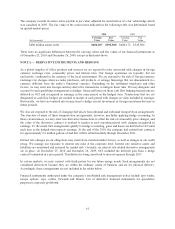

Please find page 56 of the 2010 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.allegations, he agreed to an SEC order requiring future compliance with Regulation FD and agreed to pay a civil

penalty. The settlement concludes for the company and its former Chief Executive Officer all matters arising

from the SEC investigation.

On December 13, 2010, the United States Court of Appeals for the Eleventh Circuit affirmed the dismissal with

prejudice of the Consolidated Lawsuit (defined below). As background, in early November 2007, two putative

class action lawsuits were filed against the Company and certain of its executive officers alleging violations of

the Securities Exchange Act of 1934. The allegations made in these lawsuits primarily related to the accounting

for vendor program funds. Each of the foregoing lawsuits was filed in the United States District Court for the

Southern District of Florida and captioned as follows: (1) Nichols v. Office Depot, Inc., Steve Odland and

Patricia McKay filed on November 6, 2007 and (2) Sheet Metal Worker Local 28 Pension Fund v. Office Depot,

Inc., Steve Odland and Patricia McKay filed on November 5, 2007. On March 21, 2008, the district court entered

an Order consolidating the class action lawsuits (the “Consolidated Lawsuit”). Lead plaintiff in the Consolidated

Lawsuit, the New Mexico Educational Retirement Board, filed its Consolidated Amended Complaint on July 2,

2008, and its Second Consolidated Amended Complaint on April 20, 2009. On January 14, 2010, the district

court dismissed the Second Consolidated Amended Complaint with prejudice, which led to the aforementioned

appeal.

In addition, in the ordinary course of business, our sales to and transactions with government customers may be

subject to investigations, audits and review by governmental authorities and regulatory agencies, with which we

cooperate. Many of these investigations, audits and reviews are resolved without incident. While claims in these

matters may at times assert large demands, we do not believe that contingent liabilities related to these matters,

either individually or in the aggregate, will materially affect our financial position, results of our operations or

cash flows. Among such matters, during the first quarter of 2011, we were notified that the United States

Department of Justice has commenced an investigation into certain pricing practices related to an expired

agreement that was in place between January 2, 2006 and January 1, 2011, pursuant to which state, local and

non-profit agencies could purchase office supplies.

NOTE J — EMPLOYEE BENEFIT PLANS

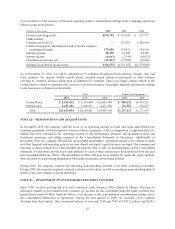

Long-Term Incentive Plan

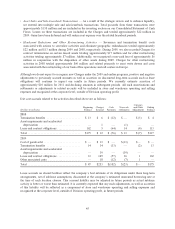

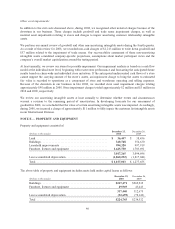

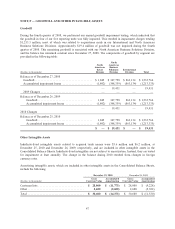

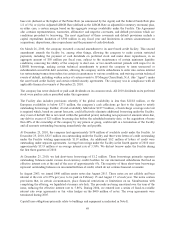

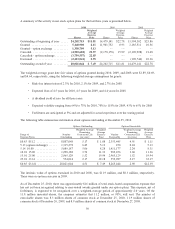

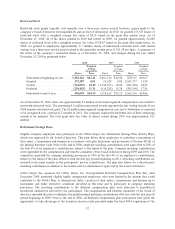

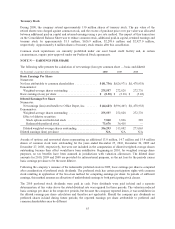

During 2007, the company’s board of directors adopted, and the shareholders approved, the Office Depot, Inc.

2007 Long-Term Incentive Plan (the “Plan”). The Plan permits the issuance of stock options, stock appreciation

rights, restricted stock, restricted stock units, performance-based, and other equity-based incentive awards. The

option exercise price for each grant of a stock option shall not be less than 100% of the fair market value of a

share of common stock on the date the option is granted. Options granted under the Plan become exercisable

from one to five years after the date of grant, provided that the individual is continuously employed with the

company. All options granted expire no more than ten years following the date of grant. Our employee share-

based awards are generally issued in the first quarter of the year.

Long-Term Incentive Stock Plan

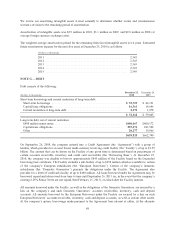

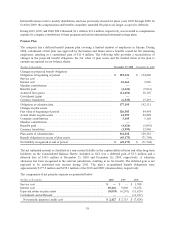

During 2010, the company implemented a one-time voluntary stock option exchange program that had been

approved by the board of directors and the company’s shareholders. The fair value exchange program resulted in

the tender of 3.8 million shares of eligible options in exchange for approximately 1.4 million of newly-issued

options. No additional compensation expense resulted from this value-for-value exchange. The new options have

an exercise price of $5.13, which was the closing price of Office Depot, Inc. common stock on the date of the

exchange, and the majority of the options will vest over three years. The fair value of the exchanged shares was

$2.97 per share. The new options are listed separately in the tables below.

55