Office Depot 2010 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2010 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

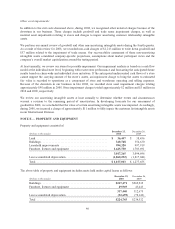

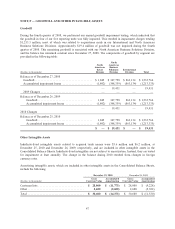

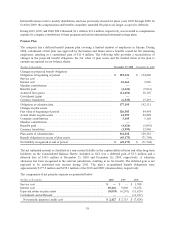

We review our amortizing intangible assets at least annually to determine whether events and circumstances

warrant a revision to the remaining period of amortization.

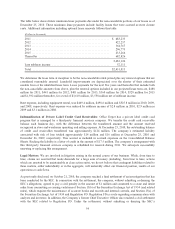

Amortization of intangible assets was $2.9 million in 2010, $3.1 million in 2009, and $9.0 million in 2008 (at

average foreign currency exchange rates).

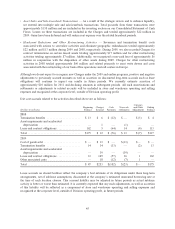

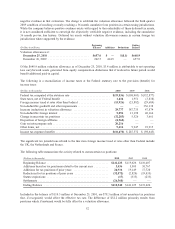

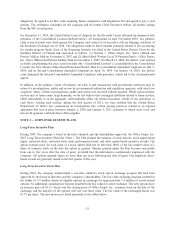

The weighted average amortization period for the remaining finite-lived intangible assets is 6.4 years. Estimated

future amortization expense for the next five years at December 25, 2010 is as follows:

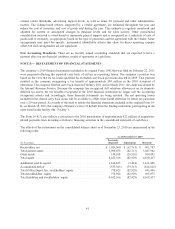

(Dollars in thousands)

2011 ....................................................... 2,545

2012 ....................................................... 2,545

2013 ....................................................... 2,545

2014 ....................................................... 2,545

2015 ....................................................... 2,545

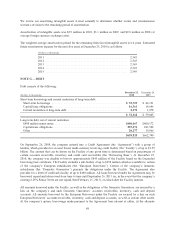

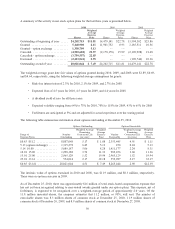

NOTE G — DEBT

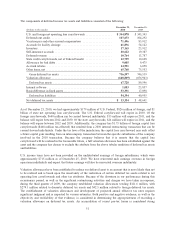

Debt consists of the following:

(Dollars in thousands)

December 25,

2010

December 26,

2009

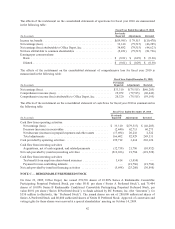

Short-term borrowings and current maturities of long-term debt:

Short-term borrowings ................................................ $ 53,729 $ 44,121

Capital lease obligations ............................................... 16,361 14,646

Current maturities of long-term debt ..................................... 2,278 1,078

$ 72,368 $ 59,845

Long-term debt, net of current maturities:

$400 million senior notes .............................................. $400,067 $400,172

Capital lease obligations ............................................... 239,476 243,502

Other .............................................................. 20,277 19,066

$659,820 $662,740

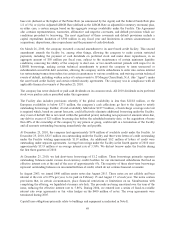

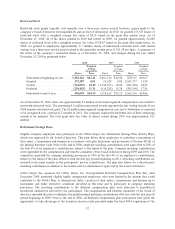

On September 26, 2008, the company entered into a Credit Agreement (the “Agreement”) with a group of

lenders, which provides for an asset based, multi-currency revolving credit facility (the “Facility”) of up to $1.25

billion. The amount that can be drawn on the Facility at any given time is determined based on percentages of

certain accounts receivable, inventory and credit card receivables (the “Borrowing Base”). At December 25,

2010, the company was eligible to borrow approximately $845 million of the Facility based on the December

borrowing base certificate. The Facility includes a sub-facility of up to $250 million which is available to certain

of the company’s European subsidiaries (the “European Borrowers”). Certain of the company’s domestic

subsidiaries (the “Domestic Guarantors”) guaranty the obligations under the Facility. The Agreement also

provides for a letter of credit sub-facility of up to $400 million. All loans borrowed under the Agreement may be

borrowed, repaid and reborrowed from time to time until September 26, 2013 (or, in the event that the company’s

existing 6.25% Senior Notes are not repaid, then February 15, 2013), on which date the Facility matures.

All amounts borrowed under the Facility, as well as the obligations of the Domestic Guarantors, are secured by a

lien on the company’s and such Domestic Guarantors’ accounts receivables, inventory, cash and deposit

accounts. All amounts borrowed by the European Borrowers under the Facility are secured by a lien on such

European Borrowers’ accounts receivable, inventory, cash and deposit accounts, as well as certain other assets.

At the company’s option, borrowings made pursuant to the Agreement bear interest at either, (i) the alternate

48