Office Depot 2010 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2010 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

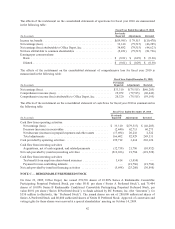

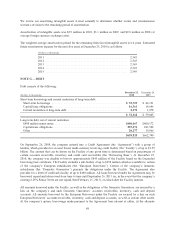

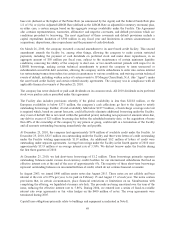

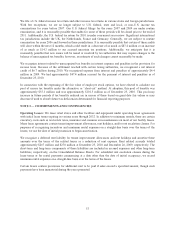

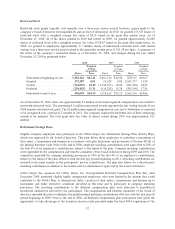

Aggregate annual maturities of long-term debt and capital lease obligations are as follows:

(Dollars in thousands)

2011 .............................................................. $ 89,808

2012 .............................................................. 33,546

2013 .............................................................. 432,383

2014 .............................................................. 31,518

2015 .............................................................. 31,915

Thereafter .......................................................... 250,312

Total .............................................................. 869,482

Less amount representing interest on capital leases .......................... 137,294

Total .............................................................. 732,188

Less current portion .................................................. 72,368

Total long-term debt .................................................. $ 659,820

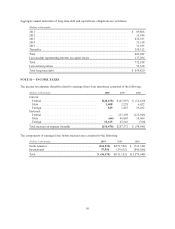

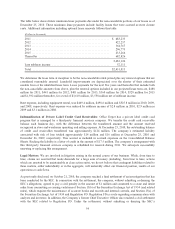

NOTE H — INCOME TAXES

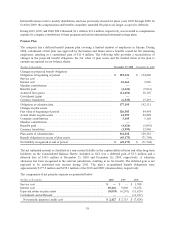

The income tax expense (benefit) related to earnings (loss) from operations consisted of the following:

(Dollars in thousands) 2010 2009 2008

Current:

Federal ...................................... $(28,278) $ (41,997) $ (16,430)

State ........................................ 1,408 2,228 6,622

Foreign ...................................... 849 1,455 19,262

Deferred :

Federal ...................................... —233,398 (125,945)

State ........................................ (64) 46,845 18,606

Foreign ...................................... 15,615 45,643 (760)

Total income tax expense (benefit) .................. $(10,470) $287,572 $ (98,645)

The components of earnings (loss) before income taxes consisted of the following:

(Dollars in thousands) 2010 2009 2008

North America ............................... (114,231) $(271,520) $ (733,342)

International ................................ 57,556 (39,632) (846,306)

Total ...................................... $ (56,675) $(311,152) $(1,579,648)

50