Office Depot 2010 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2010 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

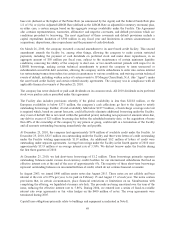

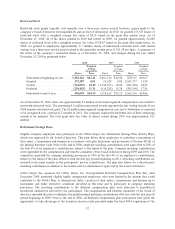

negative evidence in that evaluation. The charge to establish the valuation allowance followed the third quarter

2009 condition of reaching or nearly reaching a 36 month cumulative loss position in certain taxing jurisdictions.

While the company believes positive evidence exists with regard to the realizability of these deferred tax assets,

it is not considered sufficient to outweigh the objectively verifiable negative evidence, including the cumulative

36 month pre-tax loss history. Deferred tax assets without valuation allowances remain in certain foreign tax

jurisdictions where supported by the evidence.

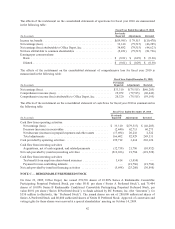

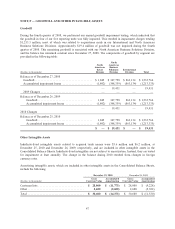

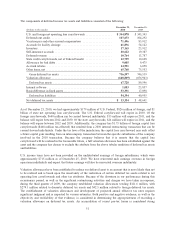

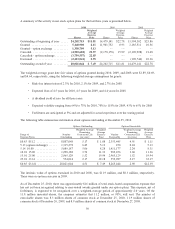

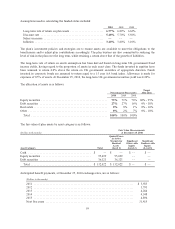

(Dollars in millions)

Beginning

Balance Additions Deductions

Ending

Balance

Valuation allowances at:

December 25, 2010 ............................ $657.0 $ — $(8.1) $648.9

December 26, 2009 ............................ 242.5 414.5 — 657.0

Of the $648.9 million valuation allowance as of December 25, 2010, $3.4 million is attributable to net operating

loss carryforward assets generated from equity compensation deductions that if realized in future period would

benefit additional paid-in capital.

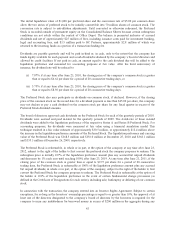

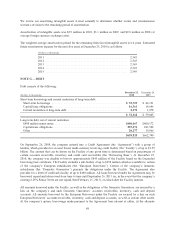

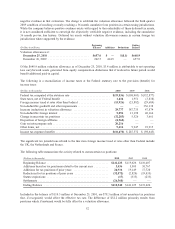

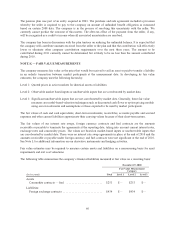

The following is a reconciliation of income taxes at the Federal statutory rate to the provision (benefit) for

income taxes:

(Dollars in thousands) 2010 2009 2008

Federal tax computed at the statutory rate ........................... $(19,836) $(108,903) $(552,877)

State taxes, net of Federal benefit ................................. 1,434 1,951 (3,838)

Foreign income taxed at rates other than Federal ..................... (15,926) (21,882) (29,684)

Non-deductible goodwill and other impairments ...................... —— 356,138

Increase (reduction) in valuation allowance ......................... 29,777 387,735 47,874

Non-deductible foreign interest ................................... 5,094 13,198 40,166

Change in uncertain tax positions ................................. (32,283) 5,526 3,661

Disposition of foreign affiliates ................................... (8,562) ——

Gain on intercompany sale ....................................... 20,216 ——

Other items, net ............................................... 9,616 9,947 39,915

Income tax expense (benefit) ..................................... $(10,470) $ 287,572 $ (98,645)

The significant tax jurisdictions related to the line item foreign income taxed at rates other than Federal include

the UK, the Netherlands and France.

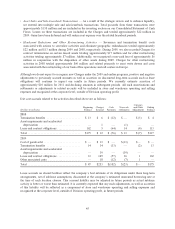

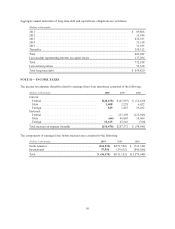

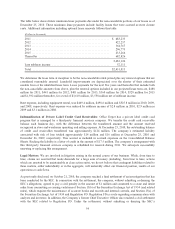

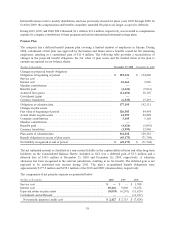

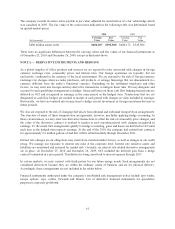

The following table summarizes the activity related to our uncertain tax positions:

(Dollars in thousands) 2010 2009 2008

Beginning Balance .......................................... $141,125 $119,626 $110,407

Additions based on tax positions related to the current year .......... 3,436 5,505 10,767

Additions for tax positions of prior years ........................ 24,936 19,149 17,720

Reductions for tax positions of prior years ....................... (32,572) (2,820) (19,035)

Statute expirations .......................................... (17) (335) (233)

Settlements ................................................ (26,368) ——

Ending Balance ............................................ $110,540 $141,125 $119,626

Included in the balance of $110.5 million at December 25, 2010, are $78.3 million of net uncertain tax positions

that, if recognized, would affect the effective tax rate. The difference of $32.2 million primarily results from

positions which if sustained would be fully offset by a valuation allowance.

52