Office Depot 2010 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2010 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE A — SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Nature of Business: Office Depot, Inc. (“Office Depot”) is a global supplier of office products and services

under the Office Depot®brand and other proprietary brand names. As of December 25, 2010, we sold to

customers in 53 countries throughout North America, Europe, Asia and Latin America. We operate wholly-

owned entities, majority-owned entities or participate in other ventures covering 41 countries and have alliances

in an additional 12 countries.

Basis of Presentation: The consolidated financial statements of Office Depot and its subsidiaries have been

prepared in accordance with accounting principles generally accepted in the United States of America. All

intercompany transactions have been eliminated in consolidation. In addition to wholly owned subsidiaries, we

consolidate entities where we control financial and operating policies but do not have total ownership.

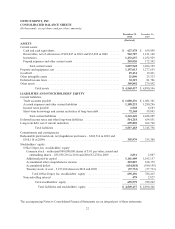

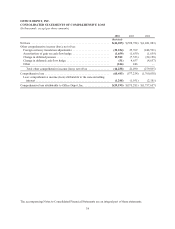

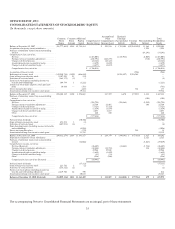

Noncontrolling interests are presented in the Consolidated Balance Sheets and Consolidated Statements of

Stockholders’ Equity as a component of total stockholders’ equity and in the Consolidated Statements of

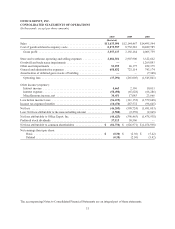

Operations as a specific allocation of net earnings (loss). The equity method of accounting is used for our

investments in which we do not control but we either share control equally or have significant influence. During

2010, we amended the shareholders’ agreement related to our venture in India such that control is now shared

equally. The venture has been deconsolidated and is now accounted for under the equity method. We also

participate in a joint venture selling office products and services in Mexico and Central and South America that is

accounted for using the equity method with its results presented in miscellaneous income, net in the Consolidated

Statements of Operations. See Note R for information on our investment in Mexico. The December 26, 2009

balance sheet has been modified to combine short term deferred income taxes with prepaid expenses and other

current assets, to conform to the December 25, 2010 presentation.

Fiscal Year: Fiscal years are based on a 52- or 53-week period ending on the last Saturday in December. All

years presented are based on 52 weeks. Fiscal year 2011 will include 53 weeks.

Estimates and Assumptions: Preparation of these financial statements in conformity with accounting principles

generally accepted in the United States of America requires management to make estimates and assumptions that

affect amounts reported in the financial statements and related notes. For example, estimates are required for, but

not limited to, facility closure costs, asset impairments, amounts earned under vendor programs, contingencies

and valuation allowances on deferred tax assets. Actual results may differ from those estimates.

Foreign Currency: Assets and liabilities of international operations are translated into U.S. dollars using the

exchange rate at the balance sheet date. Revenues, expenses and cash flows are translated at average monthly

exchange rates. Translation adjustments resulting from this process are recorded in stockholders’ equity as a

component of accumulated other comprehensive income (“OCI”).

Monetary assets and liabilities denominated in a currency other than a consolidated entity’s functional currency

result in transaction gains or losses from the remeasurement at spot rates at the end of the period. Foreign

currency gains and losses are recorded in miscellaneous income, net in the Consolidated Statements of

Operations.

Cash Equivalents: All short-term highly liquid securities with maturities of three months or less from the date of

acquisition are classified as cash equivalents. Approximately $53 million and $7 million of restricted cash held

on deposit was included in other current assets at December 25, 2010 and December 26, 2009, respectively.

Approximately $47 million of restricted cash at the end of the year 2010 relates to an agreement to purchase an

entity that is pending regulatory approval.

Cash Management: Our cash management process generally utilizes zero balance accounts which provide for

the settlement of the related disbursement accounts and cash concentration on a daily basis. Accounts payable

and accrued expenses as of December 25, 2010 and December 26, 2009 included $64 million and $77 million,

37