Office Depot 2010 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2010 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

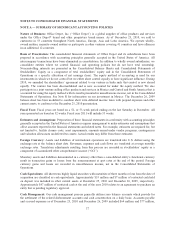

volume rebate thresholds, advertising support levels, as well as terms for payment and other administrative

matters. The volume-based rebates, supported by a vendor agreement, are estimated throughout the year and

reduce the cost of inventory and cost of goods sold during the year. This estimate is regularly monitored and

adjusted for current or anticipated changes in purchase levels and for sales activity. Other promotional

consideration received is event-based or represents general support and is recognized as a reduction of cost of

goods sold or inventory, as appropriate based on the type of promotion and the agreement with the vendor. Some

arrangements may meet the specific, incremental, identifiable criteria that allow for direct operating expense

offset, but such arrangements are not significant.

New Accounting Standards: There are no recently issued accounting standards that are expected to have a

material effect on our financial condition, results of operations or cash flows.

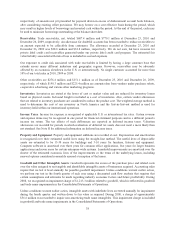

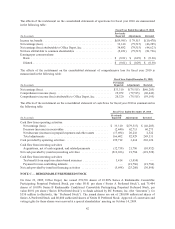

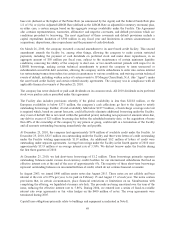

NOTE B — RESTATEMENT OF FINANCIAL STATEMENTS

The company’s 2010 financial statements included in its original Form 10-K that was filed on February 22, 2011

were prepared reflecting the expected carry back of certain net operating losses. The company’s position was

based on the view that its tax losses qualified for extended carry-back provisions enacted in 2009. That position

resulted in the company recognizing a tax benefit of approximately $80 million in the 2010 statement of

operations. The company filed its carry back claim in February 2011 and in March 2011, the claim was denied by

the Internal Revenue Service. Because the company has recognized full valuation allowances on its domestic

deferred tax assets, the tax benefits recognized in the 2010 financial statements no longer met the accounting

recognition criteria and, accordingly, these financial statements are being restated. The net operating losses

included in the denied carry back claim will be available to offset what would otherwise be future tax payments

over a 20-year period. As a result of the need to restate the financial statements included in the original Form 10-

K, on March 30, 2011 the company obtained a waiver of default from the lending institutions participating in the

asset based credit facility (the “Facility”).

The Form 10-K/A also reflects a correction to the 2010 presentation of approximately $22 million of acquisition-

related payments from investing activities to financing activities in the consolidated statement of cash flows.

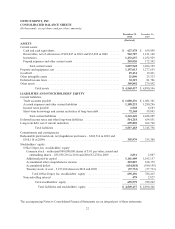

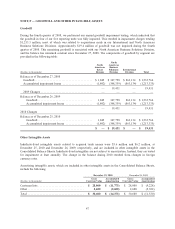

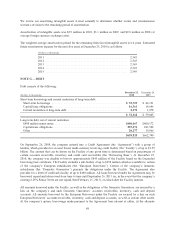

The effects of the restatement on the consolidated balance sheet as of December 25, 2010 are summarized in the

following table:

As of December 25, 2010

(In thousands)

Previously

Reported Adjustments Restated

Receivables, net .......................................... $ 1,026,500 $ (62,713) $ 963,787

Total current assets ........................................ 3,090,655 (62,713) 3,027,942

Other assets .............................................. 330,108 (20,216) 309,892

Total assets .............................................. 4,652,366 (82,929) 4,569,437

Additional paid-in capital ................................... 1,164,823 (3,414) 1,161,409

Accumulated deficit ....................................... (555,303) (79,515) (634,818)

Total Office Depot, Inc. stockholders’ equity ................... 778,425 (82,929) 695,496

Total stockholders’ equity .................................. 778,904 (82,929) 695,975

Total liabilities and stockholders’ equity ....................... 4,652,366 (82,929) 4,569,437

41