Office Depot 2010 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2010 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

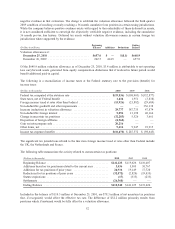

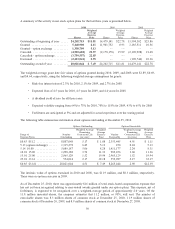

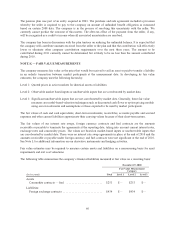

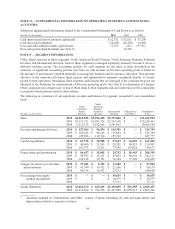

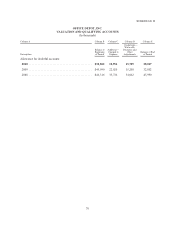

The following tables provide information on our hedging and derivative positions and activity.

Fair value of derivative instruments

(Dollars in thousands) Balance sheet location 2010 2009

Derivatives designated as hedging

instruments:

Foreign exchange contracts .......... Other current liabilities ............. 317 266

Derivatives not designated as hedging

instruments:

Foreign exchange contracts .......... Other current liabilities ............. 117 —

Total Liabilities ................. 434 266

Commodity contracts — fuel ......... Other current assets ................ 253 —

Total assets ..................... $ 253 $ —

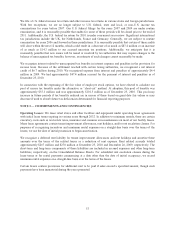

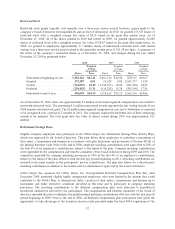

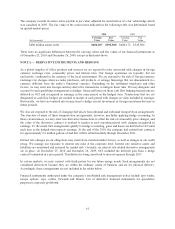

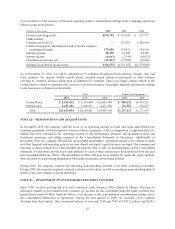

Derivatives not designated as hedging instruments Location of gain/(loss) recognized in earnings

Amount of gain/

(loss) recognized

in earnings

(Dollars in thousands) 2010 2009

Commodity contracts — fuel .......... Cost of goods sold and occupancy costs &

Store and warehouse operating and selling

expenses* ......................... $ 253 $ 111

Foreign exchange contracts ............ Cost of goods sold and occupancy

costs .............................. (117) (7,707)

Total ........................... $ 136 $(7,596)

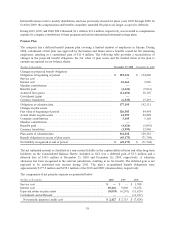

Derivatives designated as cash flow

hedges:

Amount of

gain/(loss) recognized

in OCI

Location of gain/(loss) reclassified

from OCI into earnings

Amount of gain/(loss)

reclassified from OCI

into earnings

(Dollars in thousands) 2010 2009 2010 2009

Commodity contracts — fuel . . $—$2,919 Cost of goods sold and

occupancy costs & Store and

warehouse operating and

selling expenses* .......... $—$(6,800)

Foreign exchange contracts .... (1,982) (266) Cost of goods sold and

occupancy costs ........... (2,229) —

Total ................... $(1,982) $2,653 $(2,229) $(6,800)

* Approximately 60% of the amounts for 2010 and 2009 are reflected in cost of goods sold and occupancy

costs. The remaining 40% of the amounts are reflected in store and warehouse operating and selling

expenses.

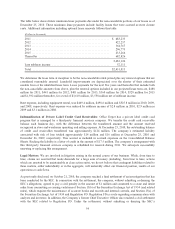

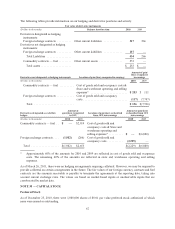

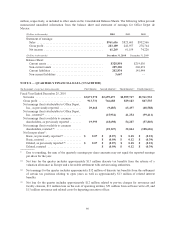

As of March 26, 2011, there were no hedging arrangements requiring collateral. However, we may be required to

provide collateral on certain arrangements in the future. The fair values of our foreign currency contracts and fuel

contracts are the amounts receivable or payable to terminate the agreements at the reporting date, taking into

account current exchange rates. The values are based on market-based inputs or unobservable inputs that are

corroborated by market data.

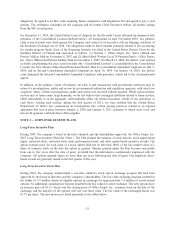

NOTE M — CAPITAL STOCK

Preferred Stock

As of December 25, 2010, there were 1,000,000 shares of $0.01 par value preferred stock authorized of which

none were issued or outstanding.

62